It was a hot summer day. The Global Warming Gods had been working their magic on the north shore of Long Island. The dying summer breeze left the air thick and hot. It smothered young Maggie the black haired mutt, who lays trapped on the floor.

Meanwhile, the Klendathu Capitalist, had fared no better. He struggled to maintain his focus. His long blonde hair was thick with sweat. The information was starting to blur in his mind. The chart on his computer was inseparable from the last few.

I need a break, he thought.

As he was getting up he looked back at the previous few charts and it hit him. They were all the same chart… except they were different.

What follows is the story of When Micro Met Macro:

Four separate sectors: Lithium, Fertilizer, Iron Ore, and Solar Grade Silicon, with four very similar cost curves. Notice the location of where Chinese companies fall on the scale – the high cost end.

Chinese companies are inefficient. This is not news. China’s zombie companies are a well known problem. They were profitable during booming demand times when prices were higher and most importantly when wages were lower.

Since 2000 wages have more than tripled, which has put considerable pressure on Chinese company margins.

Simultaneously, the Chinese Yuan has been rising in value over the last 16 years, which has further hurt Chinese company competitiveness.

I am willing to bet that China’s zombie company problems extend far beyond these four sectors, but the issue is the same – the costs are too high.

There are many ways to skin a cat, just like there are many paths to discovery. The Chinese Yuan Devaluation is no different, and this is just another way of arriving at the same conclusion.

Unless prices dramatically rise into an oversupplied market (unlikely), the CCP will be forced to let the Yuan fall a significant amount. This will reduce the cost of labor, and the debts these Chinese companies hold. With a weaker Yuan, China will save some zombie companies and even some of the healthier companies that have struggled to survive in such a harsh environment.

The point I’m making is that from this perspective a Yuan devaluation makes sense. And we know what a deflationary event like a Yuan devaluation means for global risk assets. It’s not hard to position for this outcome. Buy treasuries, gold and short risk assets.

It’s the other side of the trade that isn’t as easy to hedge. What happens if the CCP doesn’t devalue the Yuan and can successfully delay the inevitable for another few years?

I’m quite skeptical of China’s ability to keep the game going for another year, but say I am wrong. Say China keeps the credit pumps flowing into these companies for two, three even five years without losing control.

In that case, I want to be in the strongest growing sectors of the global economy. If nothing bad happens, I want to be in the sectors or plays that will explode.

And that something as I mentioned in a previous post is the coming energy revolution. Although the time horizons do not perfectly mesh, rarely do I find a way to hedge my global macro thesis with long term technological trends.

Unless prices rise, these Chinese zombie companies will go out of business. And even if prices do rise, they would have to rise considerably higher into an oversupplied market, which is hard to do.

Even if price does rise it will likely not be sufficient to save the inefficient debt heavy Chinese companies. For reference look at oil and gas companies which are on the verge of bankruptcy even after the price of oil almost doubled.

Thus if prices remain the same or fall, production/supply will be cut. In the important energy markets, rising demand coupled with falling supply will create a sharp turn around in price. The old adage “the cure for low prices is low prices” holds again.

Seems obvious, and maybe it is, but you also have to pick the right sector. Which brings me to Solar Grade silicon metal (SG Si), or the silicon used to make solar panels.

![]()

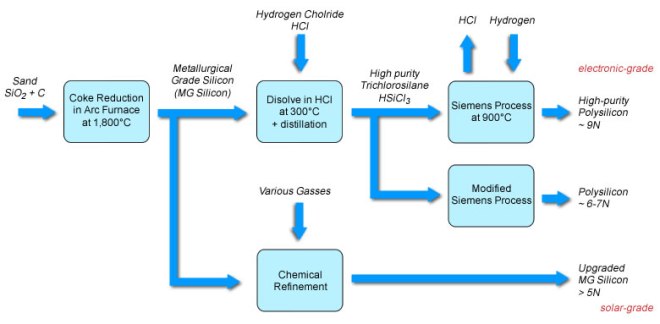

The current process for making solar grade silicon, the Siemens Process, consists of multiple steps, large amounts of energy and toxic chemicals.

Back when the price of Silicon was 3 or 4 times higher than it was today, it made sense to scale this process up.

![]()

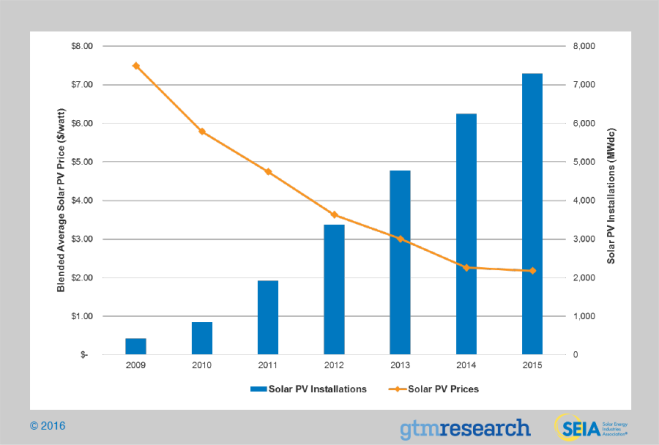

No one expected silicon metal prices would fall this much. Meanwhile demand is rising… quite rapidly.

And yet the price is not rising enough to give reprieve to the underwater companies.

![]()

It’s unclear how some of these companies will survive. Judging by demand growth it will take at least another 2 years before demand comes close to current capacity. In the meantime, a large share of these companies will continue to lose money. Considering, Chinese cost of production has been over the price of SG Si in China since 2012, it’s not clear how much longer these companies can last.

But it gets better, because if you give an engineer enough time to solve a problem, he OR she will solve it. As I stated earlier, the current process for producing solar grade silicon is inefficient and outdated.

Long term, innovation will completely change the landscape of silicon production as companies like Silicor Materials develop and deploy new non-toxic less capital intensive processes to produce solar grade silicon metal.

Unfortunately, Silicor Materials is not a publicly traded company. But there does exist another pair of companies, Pyrogenisis Canada Inc and Uragold Bay Resources (DISCLOSURE: I am a shareholder of both) that has developed its own one step process for converting quartz into solar grade silicon metal.

These companies should be able to undercut the current competition in a growing market. It’s hard to imagine a more bullish set up.

I haven’t been “doing macro” long, or at least not very well, and rarely have I seen a way to hedge my macro views with a bullish technological trend. Silicon is still the most expensive component of the solar panel. As new technologies are adopted dragging down costs, solar’s adoption will grow.

But silicon isn’t the only space I’m looking at. Graphite, another resource almost completely dominated by Chinese production is a similar space ripe for innovation.

Of course you cannot mention graphite without mentioning graphene, which is arguably the most important material to be created in the last 100 years and that’s including anti-matter. The unique 2-D material may soon be mass produced as a byproduct from high grade graphite mines.

The impacts this material will have on our lives is practically limitless and beyond imagination, but the time horizon is rapidly approaching. Within five years we could see mass produced graphene appear in products all over the world.

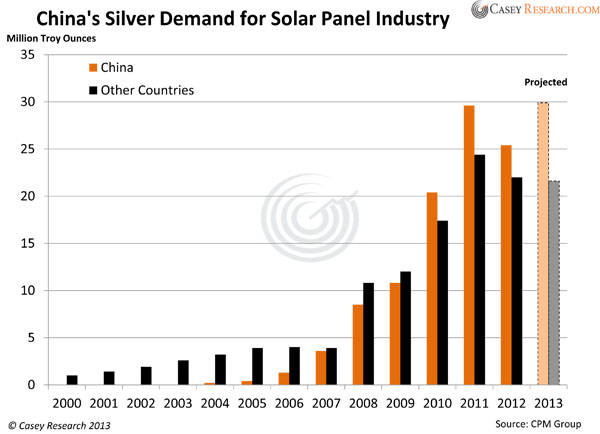

Once again, bringing micro back to macro, silver is also a key component in solar panels. Although it should be noted that solar panel demand for silver makes up for less than 10% of total silver production.

Not all of the knock on effects of the booming solar industry have been listed. I failed to list the revolutionary potential solar power promises for emerging markets with poor grid infrastructure in Africa, South America, and South Asia. Or the more obvious death of coal fired power plants, and the potential rising demand for nuclear power as the major player in base load power.

I’m going to state the very obvious, but widely ignored: Technological trends, not just solar power, will shape the world and bring sustainable growth at time when growth has never been more paramount. It’s important to recognize such trends and invest in them. The number of positive knock on effects make it that much easier to stay diversified geographically, and politically as well giving the ability to hedge against bearish macro views.

DISCLOSURE: I own shares in Urabay Gold Resources (UBR.cve) and Pyrogenisis Inc (PYR.cve) as well as Talga Resources (TLG.asx) and the commodity silver.

Pingback: The Bond Plateau – The Klendathu Capitalist