Nine months into the year it’s hard to imagine how the markets could be further removed from 2018’s initial lofty expectations of global synchronized growth. Per usual the same goes for the narrative surrounding President Trump. As recent as the spring, investors believed the USD was uninvestable because of President Trump’s policies. Tillerson had just been fired and investors were panic selling the USD. From CNBC:

“Trump just removed another voice of reason,” said Keith Underwood, former trader and head of Underwood FX consulting. “Short-term traders took advantage of people’s fears over the tariffs and pushed the dollar lower.”

Yet now we find the consensus narratives to be polar opposites of what they once were just months prior. Investors have to buy the USD because of Trump and his trade policies, and because the USD is going up it’s hurting China, Emerging Markets and global growth. European growth is nowhere to be found. And because we are “late cycle” and private tech valuations are out of control investors are quick to scare. And if that wasn’t enough, the upcoming US midterm elections are weighing on investors belief that Trump will still be President in 2019.

There’s a lot of uncertainty, worry, and fear out there when there wasn’t much just a few months ago. The dramatic shift in the narrative has caught many investors off guard. And yet we must remember that these are still narratives. The future’s not set in stone and if the narrative can shift this quickly in one direction it can just as easily shift in the opposite direction.

In this case, there’s a lot of uncertainty out there and it’s keeping a lid on risk assets, but by the end of the year I expect a lot of these fears to abate.

The odds of a meltdown in China or a devaluation of its currency are much lower than the market has priced in. The same goes for the “EM crises”. With numerous trade deals coming down the pipe, Trump’s trade wars are not going to crush global growth and drive the USD higher, and if all this is true Trump’s odds of holding onto his power are much higher than the market expects as well.

What I believe most investors are missing is the political solution to these many problems. At every turn investors have underestimated and misjudged Trump and continue to do so.

And because investors continue to underestimate Trump’s ability, they have mispriced the timing of a US China trade deal. The consensus view is that China is going to wait out Trump till after midterms where he could be considerably weakened. Which on some level makes sense. Except Trump has all the leverage, and China has a lot to gain by coming to the table.

China and the US can be fierce enemies but they can also be fierce friends and with pragmatic leaders at the helm of both powers I expect the latter to be the more likely case.

Progress on North Korea, a proxy for US China relations, continues to improve.

Furthermore, it’s important to realize who has the leverage in the negotiations. Since Trump started turning the screws on China in March, the equity markets have diverged. (QQQ / US tech in red, CQQQ / China tech in black)

By the way if we think about the timing of Trump’s actions we will once again find him wiser than the market gives him credit.

Then again the S&P 500 despite all the fear mongering recently broke to all time highs. Perhaps the market isn’t so dumb…

Stock market intelligence aside, just a few months after Trump started turning the screws on China Bannon came out and said that essentially the US has all the leverage:

“We are winning. They talk about the Chinese government coming back at us but for the first time they don’t know what to do… We can take the whole thing down.”

And Bannon said that before the US and Mexico agreed to a new trade deal that would shift US supply chains out of China and into Mexico.

https://twitter.com/FWIWmacro/status/1034290242386362370

Furthermore the trade deal with Mexico provides evidence that Trump is willing to negotiate fair deals with other nations.

Once again we find that Trump’s twitter feed has to be read with a certain lens.

But to sum up, the US has won this round of the trade wars. A deal between the US and China is coming sooner than the market expects. And this deal will have profound implications for the USD.

Following the US Mexico trade deal Mnuchin said the following (my emphasis added):

One of the top issues we discussed was the currency. As part of any deal, we would want to make sure that they support their currency. We’re not going to have a situation where we pick up gains in trade to only lose them in currency devaluation. And as part of the NAFTA deal, for the first time we have a very strong currency chapter that talks about currency transparency, so this is something we’re very much focused on in all of our trading relationships.

And then speaking on China’s Yuan.

As Worth Wray has been saying for many months (if not years), Trump is aiming for a Plaza Accord type agreement that will lead to a global rebalancing.

https://twitter.com/FWIWmacro/status/1034421988675256321

Thus if there is a coordinated action to weaken or at least halt the rise of the USD, emerging markets may not be as bad as consensus thinks.

According to the article there is simply no shortage of reasons to be afraid out there.

“Blame it on a stronger dollar, escalating tensions since President Donald Trump came to power, worries over a full-fledged trade war with China or rising interest rates in the U.S., this time around the crisis seems to have entered a new phase.”

As I have already suggested, many of these fears appear to be overblown. And what if Emerging markets and China are actually more stable than investors realize?

EM high yield credit spreads are also telling a different story or for the more pessimistic investor how much further this crisis has to go IF things get out of hand.

https://twitter.com/teasri/status/1037439234037178368

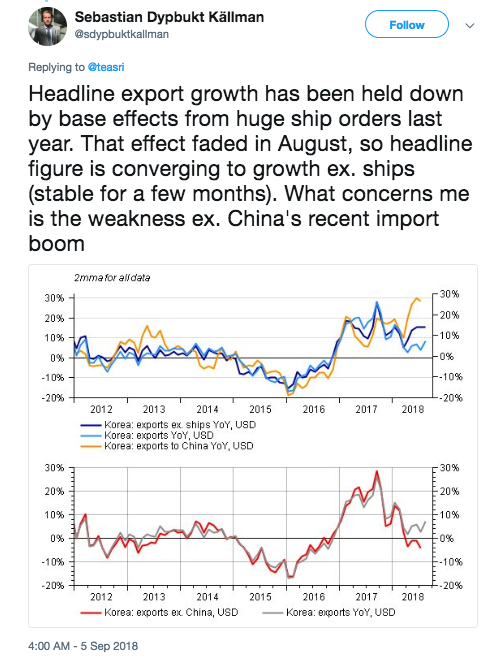

Korea’s exports to China have actually begun to rebound in August.

Even the perennial country of the future Brazil is holding up.

https://twitter.com/teasri/status/1037052954241581057

Furthermore, Brazil’s leading Presidential candidate was stabbed and seriously injured on Thursday. And yet USDBRL has since fallen. And Brazilian equity markets were actually up on the day. Brazilian ETF (EWZ) is on support with a positive RSI divergence to boot.

Lastly, the most binary and unpredictable event in markets is the midterms which have turned into the re-election of Donald Trump.

If the Dems win, there will be an impeachment and Trump’s legislative agenda will grind to a halt. This is undoubtedly weighing on markets. Where it stands right now, Trump’s chances of weathering the storm appear murky at best. But given all the geopolitical and economic fears out there investors once again may be missing the bigger picture.

It’s the economy stupid.

https://twitter.com/karenhandel/status/1037355852024492032

Now imagine how much the US economy could rip once the trade deals form into place and businesses have a clearer picture of the geopolitical environment. From the LA Times:

“Several big manufacturers and consumer goods companies have cited growing trade tensions as factors for their lower-than-expected financial results in the just-ended second quarter.”

Which makes the ISM manufacturing index 14 year high even more remarkable.

Trump is also riding a growing wave of support from black voters.

From the 2017 book Bannon: Always the Rebel:

“I keep telling people. Once we get 25 or 30 percent of the black working class, once we get 25 or 30 percent of the hispanic working class, we’re gonna govern for 100 years.”

Trump is converting the Republican party into a worker’s party. By halting illegal immigration he is boosting wages for the poorest Americans. By cutting taxes, and deregulating the economy and attacking unfair trade deals he’s made the US a more attractive place to invest. Jobs are coming back and wages are starting to rise.

By aligning himself directly with the working class, Trump has forced the Democrats into a near impossible position. They either work with him which would help him, or they have to attack him and by proxy the working class citizens as well.

It’s clear which route the Democrats have taken, but the stronger the economy gets the harder it will be for the Dems to fight back. Their political attacks increasingly resonate as hollow and before long I expect Trump to disarm them of their precious Mueller investigation.

In the end, Trump’s chances of holding onto his power are much higher than the market anticipates and it could become clear to the market before the election ever takes place. And as the final cherry on top of this bearish to bullish narrative shift, we could see the market go from pricing in a complete halt of Trump’s legislative agenda to tax cuts 2.0 and a massive infrastructure spending bill.

DISCLAIMER: This blog is the diary of a twenty something millennial who has never stepped foot inside a wall street bank. He has not taken an economic or business course since high school (which he is immensely proud of) and has been long gold since 2012 (which he is not so proud of). In short his opinions and experiences make him uniquely unqualified to give advice. This blog post is NOT advice to buy or sell securities. He may have positions in the aforementioned trades/securities. He may change his opinion the instant the post is published. In short, this blog post is pure fiction based loosely on the reality of the ever shifting narrative of the markets. These posts are meant for enjoyment and self reflection and nothing else. So ENJOY and REFLECT!

you’re good

LikeLiked by 1 person