For my first post, I thought I’d talk about something a little less obvious. Sure I could mention the fundamentals for gold have never looked better and called it a night, but no. I want to say something that may not be on everyone’s mind. The price of iron.

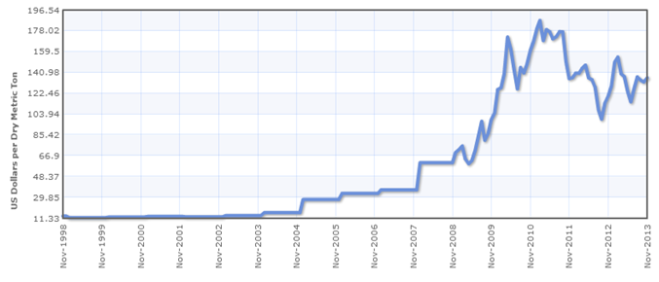

China has seen ridiculous maybe even ludicrous economic growth during the past 30 years. The result of this boom, has lead to massive increases in productivity as well as consumption of raw materials. As of 2013, China consumed roughly 65% of all the iron ore produced by the world while only mining 40% themselves. The price of iron had been on an absolute tare up until 2011. Since then it has undergone a 25% correction and sits roughly at $135/ton. To put this in perspective, just 10 years ago, the price of iron was sitting at $13.82/ton. Roughly a 900% gain in 10 years seems quite astounding, but such is the bull market commodities have been in over that span and we have commodities, population growth and central bankers to thank for all of that. However, one of those factors (China) is looking to take a big tumble in the next year or two. The Shanghai Stock Index is down 66% from its all time highs at the end of 2007 and has been slowly falling ever since the great recession. Instead of the double digit GDP growth rates of the early 2000’s china now posts a measly 7% YoY increase (we’d kill for those numbers here in US and who knows what they’d do for them in the EU). Just this past week the People’s Bank of China (PBOC) had to lend billions of dollars to money markets to keep them liquid, and this wasn’t the first time this happened this year a lone.

The City of Lianyungang

Most importantly, China has enacted a massive urbanization program, bringing HUNDREDS of MILLIONS of people from the rural country side into the cities. This has led to a boom in infrastructure such as factories, roads, and public transportation which obviously requires large amounts of materials to make possible. However, this is not without its problems, pollution being one of them. Smog in some of the major cities such as Shanghai have reached such high levels that pilots are training to land blind. The state media has even tried to spin the pollution in a positive light saying that it hides their buildings from the possibility of Japanese missile strikes. The point I’m trying to make is something we all learned in high school economics, marginal utility. After a certain point the Chinese will have to drastically slow down their urbanization program so that the people in the cities can literally breathe. This slow down will hurt their weakening economy and possibly send it into a recession. With the China consuming and producing less commodities, iron in particular will be hit hardest. Which brings me to the investment play – shorting iron ore mining companies. Lower iron prices mean smaller or negative margins for weaker mining companies. The ones I’m looking at are in Brazil, a country which is the third largest producer of iron ore. Unlike Australia, who has an established exchange rate and trade agreement with China, Brazil on the other side of the world will be left out in the cold. With high price for oil, the long shipping distance between Brazil and China, hurts the mining companies’ margins.

Well it’s getting late and I seem to have rambled quite a bit for my first post but I hope if anyone reads this, that they get the point, China’s economy is slowing down which will hurt the prices of commodities they consume the most and anyone that sells them. Before I go, I’d like to say that I am quite bullish on China in the long term. China has great infrastructure, natural resources, and a hardworking population. The CNSA just landed a rover, Chang’e, on the moon. They have aimed their sights high and will most likely reach their goals but not without a few stumbles along the way. The next slowdown being one of them… Now perhaps I should come up with a clever sign off or last few words but I think the game of thrones reference in the title will suffice for now. Good night.