Dear Reader,

I wrote this post a few weeks ago, while on vacation but for a number of reasons I delayed posting it. If you’ve been keeping up with my posts, you’ll have already read a good portion of what follows. But what I think I’ve done here, is distilled the essence of what I believe is the reflation trade and (now that base effects are set to peak next month) its possible drivers going forward. Once again, at the very least, I hope you find this as stimulating to read as I did to write.

Cheers!

While my grandfather was working for the Institute for Defense Analysis during the 1970’s he developed an algorithm to break Russian codes. It was quite successful and would go on to be applied to a number of important areas including the solar cycle. At the time, it was widely believed that there was an 11-year cycle that drove solar activity. But an article published in 2015 titled “Irregular heartbeat of the Sun driven by double dynamo” asserts that there is a second cycle or dynamo that drives solar activity. The authors go far as to predict these two dynamos would counteract each other in the 2030’s producing a cooling period that hasn’t been seen in over 400 years.

“The model draws on dynamo effects in two layers of the Sun, one close to the surface and one deep within its convection zone. Predictions from the model suggest that solar activity will fall by 60 percent during the 2030s to conditions last seen during the ‘mini ice age’ that began in 1645”

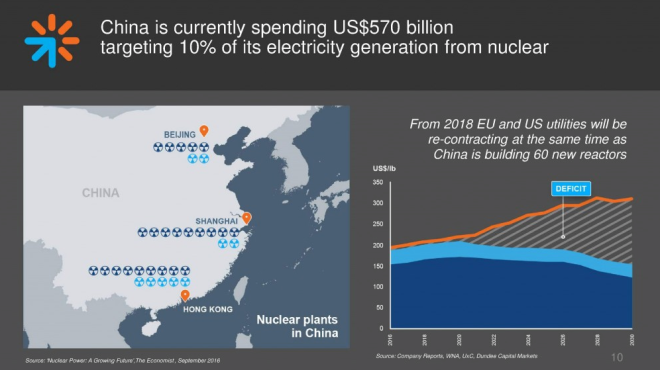

The analogies to the current climate of the global economy should not go overlooked. If the demographers and history are any guide, we are at the end of a debt super cycle, arguably the largest in history. When it ends, we too will enter a cooling period. With the emergence of China in the 21st century, the global economy finds itself driven by a pair of dynamos.

But investors have become so accustomed to the US driving the global credit cycle that they have missed the origin of the reflation trade. The dollar, commodities and inflation have all risen together for the first time in over a decade which has left investors scrambling for a narrative to explain this paradox. Fortunately, the recent US presidential election has provided just that. Despite the “coincidence” of commodities bottoming with China’s economy in February of last year, investors have latched on whole heartily to the “Trumpflation” narrative. Or to use another analogy, investors have entered the Jade City, but they have become distracted by the Giant Green Floating Head.

Unbeknownst to investors, China is behind the curtain pulling the strings. And if we continue with the analogy, I guess my pulling back of the curtain makes me Toto.

Although I’d hardly be the first to do so. CrossBorder capital and others have been trying to tell investors for months that this was the case. But unlike them, I am not a China bull. I am in the “China is a massive bubble” camp. The reflation trade, being yet another extension of said bubble, will eventually die out. Sooner rather than later I will argue. But before I do, let’s go back and look at the mood around the start of the reflation trade.

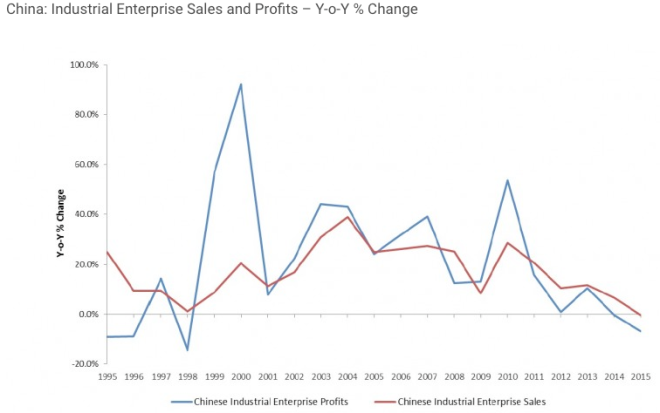

In the depths of the January 2016 sell off oil had plunged to $26, the trade weighted dollar hit a multi-decade high and most importantly, consensus believed China’s economy to be headed for a hard landing. Not to pick on Kyle Bass, but his February 2016 letter hit the proverbial nail on the head (my emphasis):

“As it is obvious that China’s economy is slowing and loan losses are mounting, the primary question is what are China’s policy options to fix the current situation?”

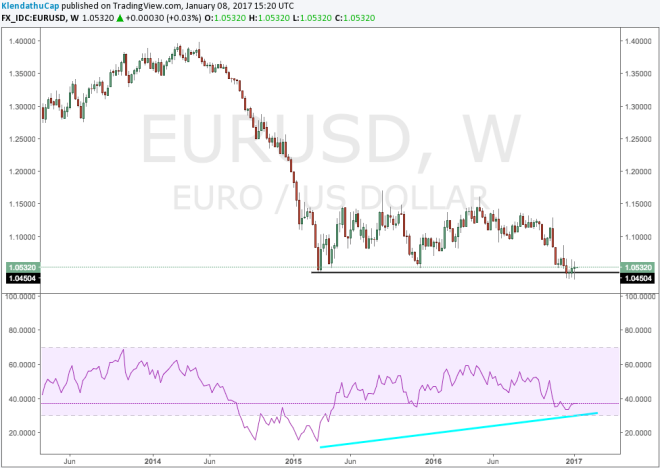

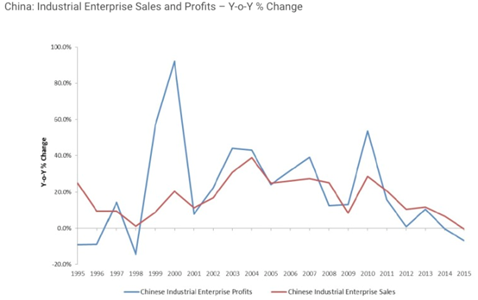

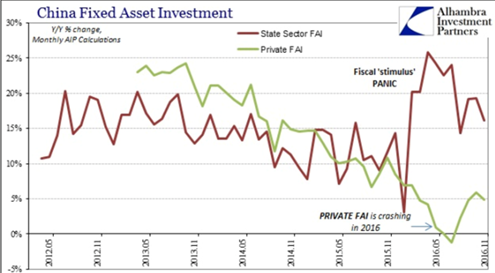

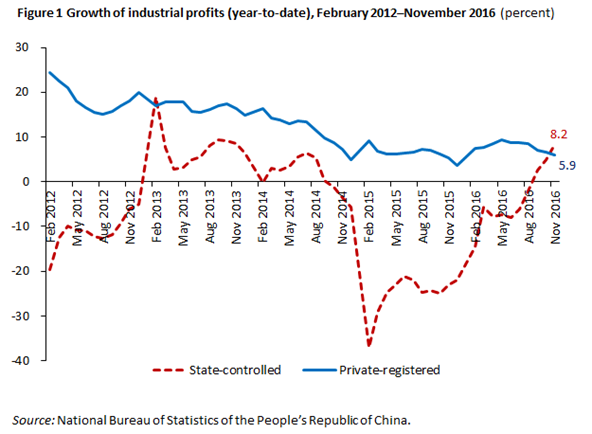

Yes, it was obvious. Looking up at the chart, industrial profits and sales had turned negative. Everyone knows you can’t service a growing debt burden on negative profits, just like everyone knows that China has an enormous debt bubble.

But unlike the 2008 financial crisis when the central authorities, the Federal Reserve and US treasury, were completely oblivious to the actual problems, the Chinese authorities, and everyone else for that matter, knew exactly what the problems were. What Kyle Bass and others (myself included) missed was that the Chinese authorities were planning a Battle of the Bulge type counter attack in the form of a massive stimulus push.

For those in need of a quick history lesson, in the winter of 1944, the Germans were trapped. Fighting a war on multiple fronts with dwindling resources it was obvious they would lose the war (sound familiar?). And because it was “so obvious” that Germany was going to lose, the Allies let down their guard and were caught flatfooted when Germany launched one of the largest counterattacks in human history. From Wikipedia:

“American forces bore the brunt of the attack and incurred their highest casualties of any operation during the war.”

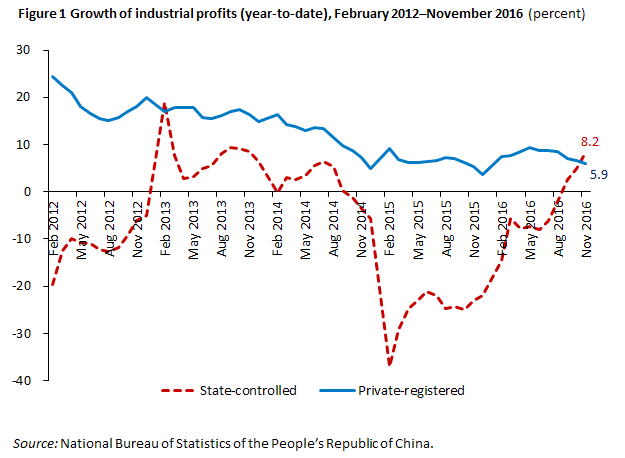

History is not without a sense of irony, as western hedge funds and speculators have had their shorts knocked off them as this reflationary trade has gone further and farther than the bears could have possibly imagined. Throwing salt in the wound, the lynch pin of the Chinese economy, State Owned Enterprises (SOEs), have roared back to life with profit growth turning positive for the first time in over two years.

But it would be foolish to think this stimulus is one, sustainable and two, without its costs. The Yuan took this reflationary policy on the chin. Despite spending $320B in reserves to defend the Yuan in 2016 it still fell 6.5% against the dollar. And even though China’s economy bottomed in Q1 2016, it still took months before the country stopped exporting deflation to the rest of the world.

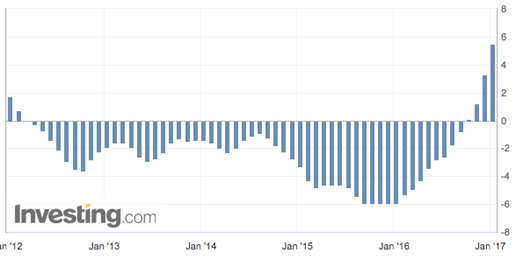

More importantly, since China had been exporting deflation for so long, the market became convinced that deflation would continue in perpetuity. I think we all remember the panic last summer to reach for anything with a positive carry. What the market and more importantly Central Bankers were missing was the fact that deflation in China had in fact bottomed, and although still negative, was rising sharply.

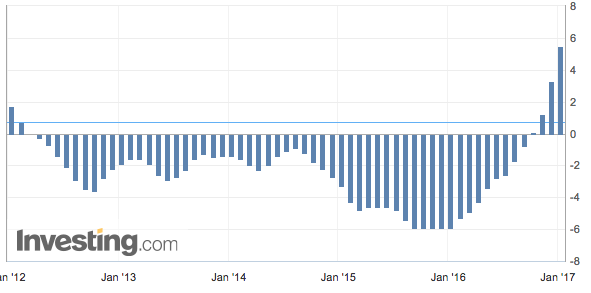

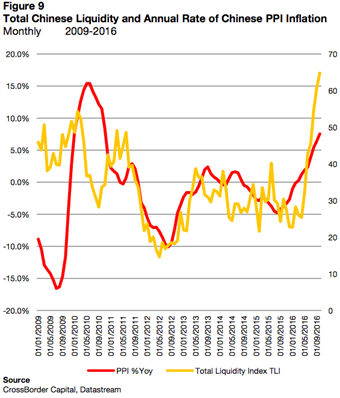

Chinese PPI

This turn from deflation to inflation also fooled Chinese investors who piled into the record low bond yields. In fact, investors’ response to these rising inflationary pressures was so slow that yields in China did not bottom until PPI had already turned positive for the first time in over 4 years!

And this is where things get very tricky for the Chinese authorities. They wanted this inflation. Just not this quickly. Locked in a deflationary debt spiral, a little inflation is a gift from the financial gods…

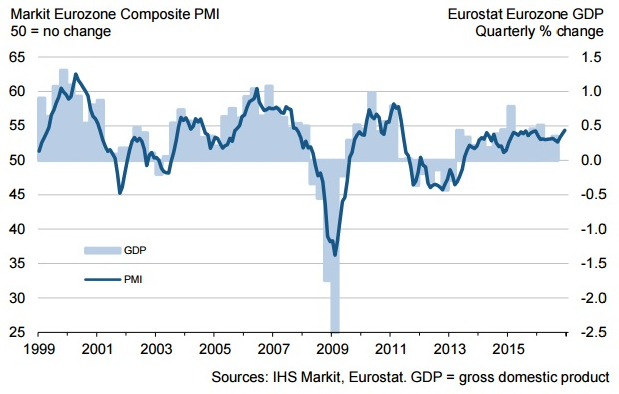

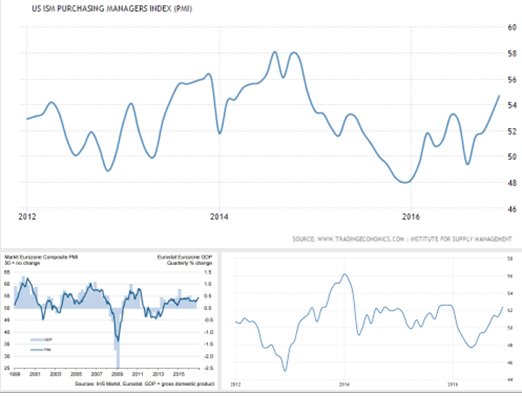

And we’ve actually seen the US, EU and Japanese economies all respond positively to these rising inflationary pressures. The combined strength of the three large economies all rising together may even be able to hold China’s slowing economy for a bit longer (we’ll get to that bit later).

…BUT in China where the bond bubble is so intertwined and over levered that a mid-size brokerage firm can’t even default on some of its debt obligations without causing a major panic, rising rates are down right catastrophic. In the depths of China’s December bond panic, a “multi-billionaire defaulted” on just $13 million worth of bonds. I use quotes, because anyone can be a billionaire if they borrow a few billion dollars and ignore the liability side of their balance sheet.

I doubt he’s the only one swimming naked. Wealth management products (WMPs) are incredibly susceptible to rising interest rates. These Ponzi-finance vehicles have increasingly invested in each other which has pushed counter party risk exponentially higher. From WSJ:

“Some 40% of the assets in wealth management products—the biggest portion—was invested in bonds as of the first half of this year, up from 29% in 2015, according to Moody’s Investors Service.”

This inter-connectivity of WMPs has further restrained the PBOC’s ability to tighten. In spite of rising inflation, if the PBOC wanted to keep the economy going they would have to inject more liquidity… and that is exactly what they did. From WSJ (my emphasis in bold):

“On Friday [December 16th], the PBOC tapped an emergency lending facility it created in 2014 to extend 394 billion yuan ($56.7 billion) in six-month and one-year loans to 19 banks. That pushes the net amount extended through the facility to 721.5 billion yuan so far in December, a monthly record, according to Beijing-based research firm NSBO.”

The Chinese government finds itself in a constant battle against short term destabilizing forces. Every time it tries to take its foot off the gas, the economy gets pulled into the deflationary whirlpool, Charybdis, prompting even more Cow Bell. I’m mixing metaphors but you get the point.

On the other hand, they can no longer stimulate as much as they want or else they’ll face, Scylla, the nine-headed inflation monster that will rip their debt to shreds. It is quite likely that China has now reached the point where stimulus’ effect on the economy over the medium term is net negative.

More specifically, artificial increases in credit pushes inflation higher which in turn pushes up interest rates which in turn tightens liquidity thereby defeating the purpose of stimulating in the first place. My guess is that the recent monthly record of stimulus injections will show up in the inflation data much sooner than the Chinese authorities would like.

And although we have not yet seen rip roaring inflation, China has gone from DEEP deflation to rising inflation within twelve short months. The Chinese Authorities are clearly aware of this shift, but it’s unlikely that they acted fast enough. The PBOC did not start tightening liquidity until a month before PPI turned positive.

It needs to be said, that by comparison, the PBOC is light years ahead of their developed market counter parts. The BOJ in particular pinned bond yields to the floor the same month that Chinese PPI had turned positive for the first time in over four years! But we’ll get to this monumental mistake later (actually we won’t, sorry). For now, let’s place our focus back on China, the epicenter of the reflation trade. If Total Chinese Liquidity is an accurate indicator, Chinese PPI could continue higher for the next few months.

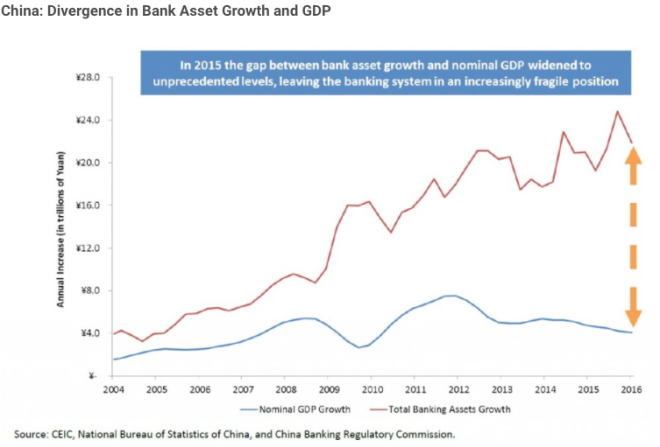

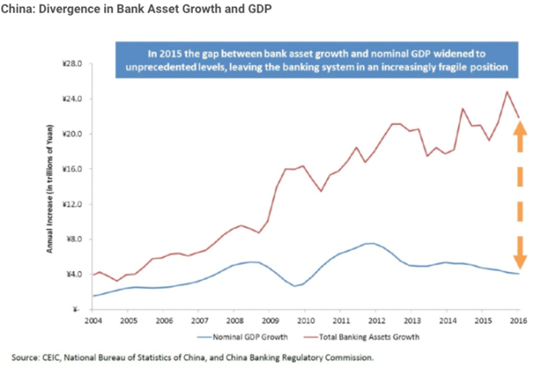

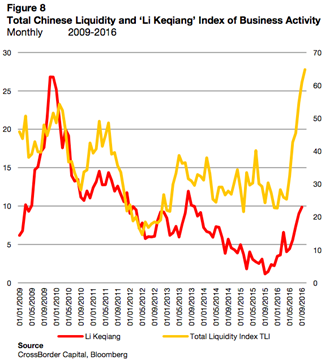

With that said, increases in liquidity have lost effectiveness on the Chinese economy over time.

For those that do not know, the Li Keqiang index is a combination of railway cargo volume, electricity consumption and loans disbursed by banks. Considering Chinese bank loans hit a new record in 2016, and enough electricity (produced via coal) was consumed to blanket North Eastern China in smog for the past few weeks, it is safe to say that this trick is unlikely to be played again. The Chinese Government’s pivot towards stability over all else further supports this thesis. From Bloomberg (emphasis is mine):

“The price was too high, the leaders agreed, according to a person familiar with the situation. The buildup of debt used to fuel smokestack industries from steel to cement had helped win the short-term battle for growth, but the triumph itself undermined the foundations of long-term expansion, the leaders decided, according to the person, who asked not to be named because the meeting was private.

What followed was an order to central and local government officials that if they are forced to choose this year, stability must be the priority while everything else, including the growth target and economic reform, is secondary, said another four people familiar with the situation.”

The prioritization of stability over growth is not exactly music to the ear of an investor who put money into China on the hopes of +7% GDP growth and a stable currency. Which begs the question, how do you maintain stability while at the same time growing your debt fueled economy without it tipping over? Given China’s shadow banking risks, rising inflation, and dwindling FX reserves the simple answer is you can’t. Like riding a bicycle, the closer your speed approaches zero the harder it is to balance.

In China’s case, they are riding a bicycle while spinning half a dozen plates of uranium while juggling a pair of Molotov cocktails. If they slow down too much, they will not only crash, they will explode. Given said conundrum, it will be interesting to see how the local governments interpret this seemingly contradictory directive of stability over growth. If the PBOC is any indicator, we are about to witness some very odd behavior coming out of the Chinese Authorities.

Taking the lunacy a step further, the PBOC cut the RRR for the 5 largest banks, and injected a even more liquidity just a week later…

Before ordering banks to curb new loans.

From Bloomberg:

“China’s central bank has ordered the nation’s lenders to strictly control new loans in the first quarter of the year, people familiar with the matter said, in another move to curb excess leverage in the financial system.”

Given the recent price action of iron ore, when it comes to China, we should always expect the unexpected.

Because clearly iron ore is in short supply in China…

Perhaps demand is set to sky rocket as China seeks to further build out OBOR projects as well as domestic projects…

Or perhaps, investors are panicking about what to do with their falling currency and are trying to hedge it. There’s a certain level of irony (pun intended… I’ll wait) that the largest source of instability in China comes from a “pegged” currency. It seems self-evident that China’s pivot towards stability would include a stable currency but given the rising inflation, slower growth pivot, dwindling reserves and lack of defensive options, one wonders just how long they can support the Yuan.

A falling Yuan is the worst thing that could happen for the Chinese Authorities. For one it undermines their credibility. Secondly, it forces the PBOC to intervene and drain liquidity from the market. And finally, it pushes inflation higher as the value of imported commodities and goods rises. With that said, recall that the Chinese bond market is a massive intertwined web of hidden risk, and in a falling liquidity and rising inflationary environment it will get butchered worse than the younglings in Star Wars Episode 3: Revenge of the Sith.

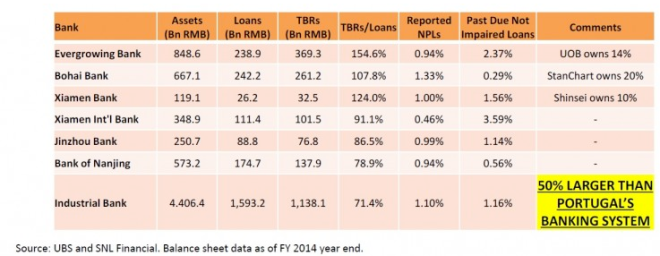

Getting back to Kyle Bass’s letter, it’s important to note the key role both Wealth Management Products (WMPs) and Trust Beneficiary Rights (TBRs) play in the Chinese Banking System. As the sticky systemic glue that binds the over-levered Chinese banking system together, they will be the focal point of any meltdown. From Kyle Bass’s letter (my emphasis):

“TBRs are one of the biggest ticking time bombs in the Chinese banking system because they have been used to hide loan losses. The table below illustrates how pervasive TBRs are throughout the Chinese banking system. One can make many assumptions regarding the collectability of such loans, but our takeaway is that the system is already full of massive losses. Pay particular attention to the column of the ratio of TBR’s to loans on each bank’s books.”

We saw just how potent TBRs can be when Sealand Securities, a midsize brokerage firm, suggested it would default on loan contracts due to a “fake seal”… or as I used to say in elementary school, “my dog ate my homework”, although honest to God, one time it did, so maybe we should give Sealand Securities the benefit of the doubt.

Although, the Chinese bond market certainly didn’t. Bond values plunged and the PBOC was forced to inject $23.7B of liquidity in one day. By the end of the month, the PBOC injected a record $120B in liquidity. Recall, this all came against the backdrop of the highest SOE profit growth in over 3 years! It didn’t matter that the underlying fundamentals of the debt had improved (albeit temporarily), the bond market still cracked! This episode appears to have spooked investor appetite for corporate debt as well.

So, if the situation is this bad that not even a medium size company can default on its TBRs without sparking a major panic, then how are the authorities supposed to “maintain stability” without pumping more liquidity into the system? And how can they pump liquidity and credit into the system without pushing down the Yuan? And how can they maintain stability if the currency is falling?

You see where I’m going with this. It’s not difficult. I don’t believe and I certainly don’t claim to have any unique insights. If there’s anything that I do possess whether right or wrong is a high conviction level which allows me to see through all the smoke screens put up by the Chinese Authorities. And yet one only needs look at investor positioning to see that they have fallen hook line and sinker for these very smoke screens! The shift is simply astounding.

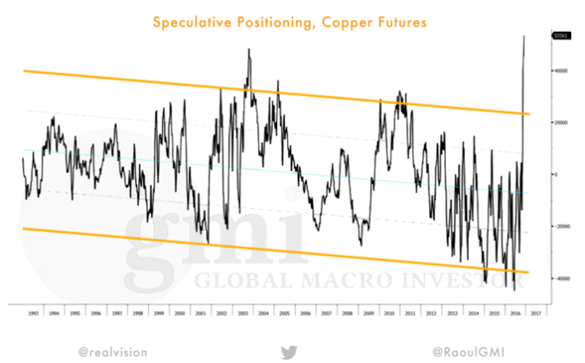

In less than a year Copper positioning has gone from record short to record long.

Net US 10-year bond positioning is at an all-time low.

And of course, oil positioning is back where it was in 2014, right before it fell over 70%.

NYSE short interest has also plummeted back to 2014 levels.

And for the cherry on top, the “world’s most bearish hedge fund” has begun to pare back its short book.

This is despite what the CIO, Russel Clark, believes is a dream set up for a potential China crisis (Zerohedge’s emphasis).

“I have been able to play into market trends that would also do well in a China crisis. But suddenly, with the election of Trump, the broader market trends are all the opposite of how you want to be positioned in a China crisis. Higher commodity prices, higher US yields, and cyclicals over staples. One answer would be to go to cash and wait it out. The problem with this is that, if you believe that a Chinese crisis is inevitable then what would be the signals to begin to put on a China crisis trade? The answer would be capital flight from China, rising Chinese yuan deposit rates in HK (as this is a commercial rate, not set by the PBOC), and increasing market talk of capital controls. Unfortunately, these are all happening today.”

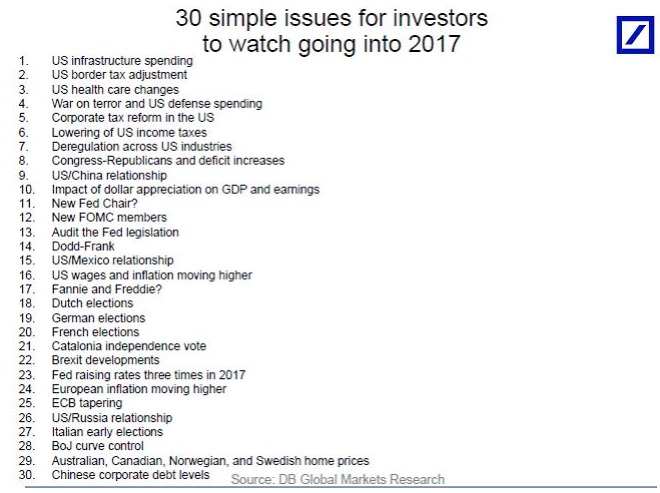

Sentiment and positioning aside, I do believe there is a good chance for the reflation trade to continue a bit further. Recall that both China’s economy and the oil price bottomed in February of last year (Coincidence?). From base effects alone these two factors should provide an inflationary tailwind over the next month or so. Given renewed developed market economy strength as well as the market’s slow reaction function (see summer bond buying panic months after deflation had bottomed) the reflationary trade could continue for an additional few months after inflationary pressures from oil and China peak in Q1 of this year.

Adding to that, I do believe there is some room over the next month for China and the Yuan to surprise to the upside. The Chinese Authorities have done a relatively good job shifting the narrative these past few weeks. Although I’d say hiking HIBOR to 105% reeks of desperation, it’s not my opinion that drives markets (if only).

I also see incredible potential for the PBOC to defend the psychologically important $3T reserve level this month. Come the release in early February, the market may be shocked to discover that the $3T reserve level has held. The Yuan could strengthen and the narrative would temporarily shift to the masterful job done by the Chinese Authorities, and developed markets would rally on the back of higher inflation.

Remember, since China is the source of the rising inflation, a stronger currency only amplifies this effect. Higher inflation in the US would push interest rates higher, strengthening the dollar and further accelerating capital flight out of China. So, by defending the currency, China is actually reinforcing the pressures that forced its defense in the first place. And of course, all of this would ignore how the PBOC might manage to hold the line in the first place. From Bloomberg:

“Financial regulators have already encouraged some state-owned enterprises to sell foreign currency and may order them to temporarily convert some holdings into yuan under the current account if necessary, they added.”

The Chinese Authorities, lauded for their long-term planning, are actually some of the best short term fixers the world has ever seen. Their ability to pull any and every lever necessary to kick the can down the road is as impressive as it is myopic. Sadly, the game, now in quintuple overtime, is almost over. The players are about to drop dead from exhaustion and this is the part where I agree 100% with Kyle Bass:

“Once analysts, politicians, and investors alike realize the sheer size of the impending losses and how they compare to the current levels of reserves, all focus will swing to the banking system.

As it is obvious that China’s economy is slowing and loan losses are mounting, the primary question is what are China’s policy options to fix the current situation? We believe that a spike in unemployment, accelerated banking losses / a credit contraction, an old-fashioned bank run, or more likely the fear of one or all of these events, will force Chinese authorities to act decisively.”

Given investor sentiment and positioning it is quite clear that China has “control” of the narrative for now. But we’ve seen how quickly that narrative can turn, and once again to use the Battle of the Bulge analogy it is important to remember just how quickly Germany folded after the battle ended. The following is an account from a German tank commander who fought in the battle:

“The Führer has asked us to do our very best and not to let him down. We only need to keep the enemy at bay for about three more months “. Three more months, then we would see the new miracle weapons and these would force the enemy to negotiate. I believed that.”

Once again the parallels to modern China are eerily similar. With the pivot towards stability, the Chinese Authorities are desperately trying to make it to the government reshuffle. Just nine more months! Nine more months and the miracle weapons, I mean Xi Jinping will have all the power he needs to manage the economy! Of course, history tells us that the battle of the bulge lasted only 40 days, and despite the war lasting another four months, the German miracle weapons never materialized.

Maybe China makes it to the government shuffle (and they probably will), but I fail to see how higher debt levels, smaller FX reserves, and rising shadow bank risk will be any more manageable under a regime where Xi has “full” control. What separates China’s coming crisis from the US’s in 08, is that it will happen not because the authorities failed to notice the problems, but because they have exhausted all capabilities to prevent it. And perhaps most importantly what separates the next global crisis from the last, is that it will most likely not be driven by the US, but by China.

Disclaimer: This blog post is not advice to buy and or sell securities. I am merely informing you of my intentions/opinions. If you act on the words of a twenty something millennial over the internet you have only yourself to blame.

Corrections: PBOC official reserves dropped $320B not $400B. The Yuan fell 6.5% against the dollar not 8% in 2016.