The author ducks.

Peering up from the keyboard with a flame retardant helmet and goggles to protect his most delicate of features he writes…

OPEC is stronger than it looks, much stronger. I’m reminded of the lava planet battle between Anakin Shalewalker and OPEC Wan Kenobi in Star Wars Episode 3.

You see, OPEC Wan Kenobi has the high ground and is better positioned to withstand an attack. He repeatedly warns young master Shalewalker any attack is folly.

But Shalewalker is young, arrogant, and brash. He ignores master OPEC’s warnings and attacks anyway, ramping up production like no one ever thought was possible. But it’s still not enough to overcome OPEC Wan Kenobi’s superior positioning and the young jedi ends up a cripple for the rest of his life.

Incredible puns and film references aside, I think US shale (and the cheap dumb money that flowed into it) will end up doing a great service to OPEC. Thanks to US shale the price of oil has been suppressed for over 2 years now. With the oil price persistently low, companies are loathe to invest in future production.

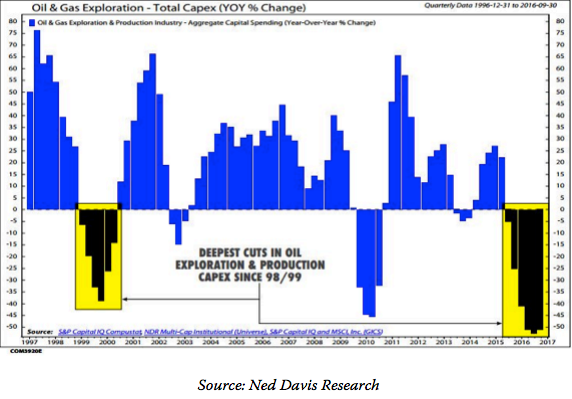

Even though we’ve seen a dramatic reduction in capex, the major oil companies saw their debt almost double from 2012 levels. From Reuters:

“Five of the largest publicly traded oil companies – BP, Chevron, Exxon Mobil, Royal Dutch Shell, and Total – are trying to work down debts that totaled $297 billion at the end of December. That nearly doubled the companies’ 2012 debt levels.

But even with oil prices about 70 percent higher than a year ago, most companies have yet to reach the point where their cash flow covers annual shareholder payouts and expansion projects vital to the industry’s long-term survival.”

The major oil companies decided instead of producing more oil in the future, they’d rather give money they don’t own to their shareholders…

And what did OPEC do during this time? They added 2m bbl per day of production.

Instead of taking on debt, OPEC members dipped into their pile of savings while at the same time investing in future production.

While reducing crude demand locally through renewable energy investments and tax incentives.

That’s all well and good, but US shale is still ready as the swing producer to put a $60 cap on the oil pice right? The magnitude of the drop in capex suggest that’s highly unlikely.

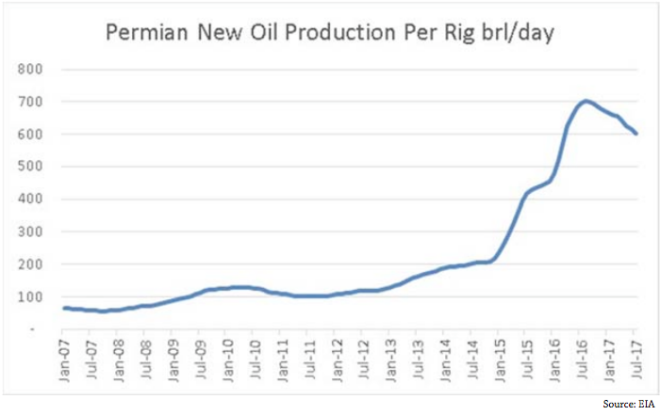

With the recent ramp up in shale production focused in the most lucrative areas. The easy oil although not gone is quickly being drained. Repeated frac-hits (where a rig drills into another operating well) might be reducing the efficiency of shale wells.

The high decline rates of shale wells is another major headwind to sustained production growth. Lastly, US shale’s ability to ramp up further production will be limited by rising service costs.

In the end, we may discover that the technological revolution of shale has as much to do with technology as it does with free money.

Unlike its competitors, OPEC has not produced oil at a loss. It has not spent money it doesn’t have. It has increased investment and now stands to profit from the myopic behavior of yield starved investors. With the world potentially on the eve of a new commodity bull market, the author quite likes the position of OPEC as a future supplier of oil demand that is highly unlikely to fall off to this supposed EV revolution (a discussion for another time).

DISCLAIMER: This blog is the diary of a twenty something millennial who has never stepped foot inside a wall street bank. He has not taken an economic or business course since high school (which he is immensely proud of) and has been long gold since 2012 (which he is not so proud of). In short his opinions and experiences make him uniquely unqualified to give advice. This blog post is NOT advice to buy or sell securities. He may have positions in the aforementioned trades/securities. He may change his opinion the instant the post is published. In short, what follows is pure fiction based loosely in the reality of the ever shifting narrative of the markets. These posts are meant for enjoyment and self reflection and nothing else. So ENJOY and REFLECT!