“What you know you can’t explain, but you feel it. You’ve felt it your entire life, that there’s something wrong with the world. You don’t know what it is, but it’s there, like a splinter in your mind, driving you mad.” ~ Morpheus

“What is clear is that, to date, computer technology has served to strengthen Technopoly’s hold, to make people believe that technological innovation is synonymous with human progress.” ~ Neil Postman

I’ve been meaning to write this blog post for awhile. I didn’t know how to start. I didn’t know where to begin. But then as happens with any crisis, an opportunity presented itself.

A virus is rampaging through the world, crippling the global economy while killing hundreds of thousands of people.

The fact that this sentence could just have easily described the 1918 Spanish Flu pandemic is precisely the point. It’s been a century since the Spanish Flu killed an estimated fifty million people and it seems that nothing has changed. Despite all our technological progress we are little better at combating a pandemic than we were over a hundred years ago. The virus, like The Joker in The Dark Knight is taunting us.

But you’ll say, “we’ve got ventilators now!”

Yes, which are incredibly costly and only offer a survival rate of approximately 20%.

“But the medicine we have is surely better then it was back then?”

The leading therapy in our fight against COVID-19, Hydroxychloroquine (HCQ), was invented in the 1950s. HCQ is derivative of a drug, methylene blue (MB), which was first synthesized in the 1876, over 40 years BEFORE the outbreak of the Spanish Flu.

Without any new medicines to combat the virus in vivo, we’ve been forced to take the battle to the streets, spraying toxic and harmful chemicals.

“But at least we have better technology to track and control the spread of the virus,” you argue.

How did that work out for the Chinese Communist Party which runs the most technologically advanced surveillance state in history?

The people who praised Singapore’s authoritarian led response to the virus have been silenced as the cases have continued to rise.

Even South Korea, the relative success story, admits that resistance, until a vaccine is developed is futile.

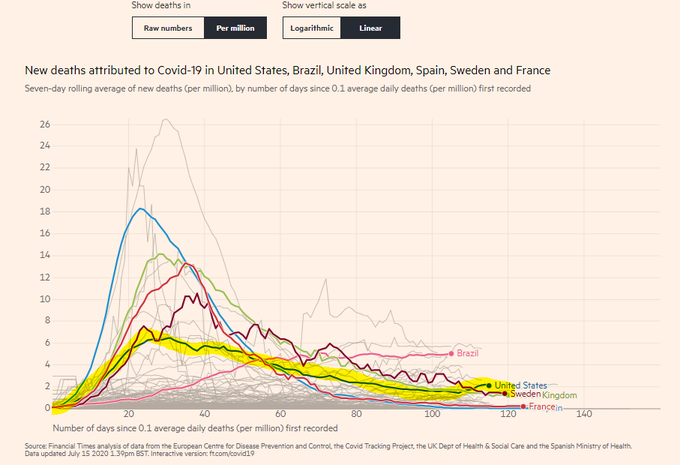

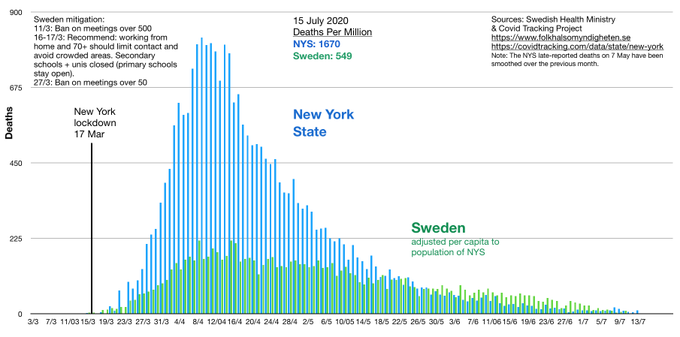

In the end, as Sweden has shown, none of these measures were needed to begin with. The country got through the first wave without heavy lockdowns or mask usage, all while being attacked and humiliated on the global stage by our supposed “experts”. And while many argued that we need to get back to build at all costs mentality, Sweden shown that all we need to do is to think, and think clearly.

Unfortunately, the rest of the world has refused to take notice and we continue to allow ourselves to be held captive by the irrational fears of a virus, waiting for a vaccine to arrive from on high, hoping that it arrives before our economy and our society are irreparably harmed. And herein lies the crux of our “problem” which society and our tech elites completely miss, we are COMPLETELY and TOTALLY reliant on technology to save us from our own ignorance.

“A whole generation adopted false principles, and went to their graves in the belief they were enriching the country they were impoverishing.” – Ralph Waldo Emerson

Now we shouldn’t be surprised that a billionaires, who have made their money money off technology’s growing encroachment into our lives (Software is eating the world), would suggest that the solution to our problem is more technology. The answer from these people always seems to be more, more, more. We need to do more. We need more money. We need more time. We need more technology. We need more people working to solve the problems…

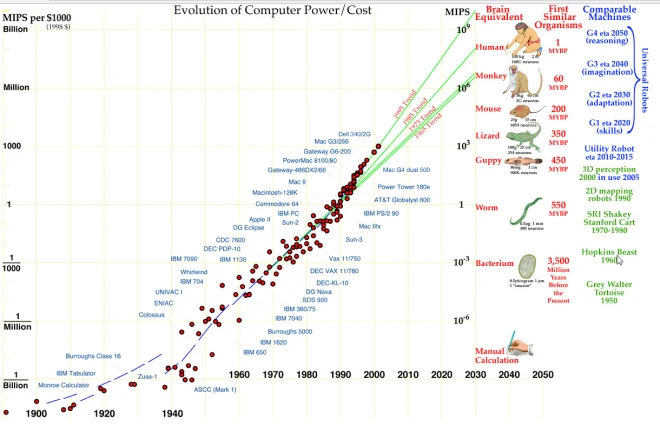

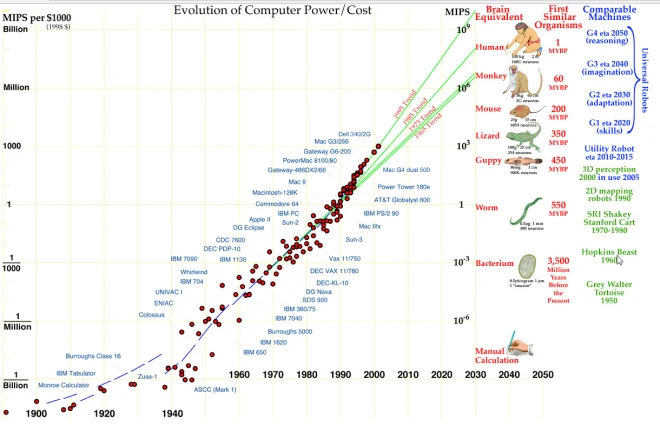

There are more scientists alive today with access to more funding than the rest of history combined and these incredibly well funded scientists have access to godlike technology.

Technology that the likes of Max Planck, Otto Warburg, Nikola Tesla and Marie Curie, Albert Einstein would have never imagined possible.

Despite this abundance of technology, and the abundance of scientists to wield it, we are as powerless to stop a simple virus from ravaging our society, grinding our economies to a halt, and killing hundreds of thousands of people as we were 100 years ago. And this is precisely why I have chosen now to write this blog post. It is this moment which so clearly illuminates the complete and total failure of modern science to build upon the prior discoveries of the early 20th century that demands not only our attention but our immediate action.

“We were promised flying cars, but instead we got 140 characters.” ~ Peter Thiel

Despite his position in the tech elite, Peter Thiel has long argued and highlighted the stagnation of the sciences and its deleterious impacts on economic growth and human progress. He has openly and correctly called out academia for being as corrupt as the Catholic Church.

Peter senses that something is off with modern science. He knows it has stagnated, and like a good philosopher he’s been searching for WHY that this is the case. And when searching for the “Why” it helps to look into the past, to figure out where and when science went down the wrong path.

“One of the best things that characterizes any good scientists is that you have to be a good skeptic. And you have to reexamine all the time what has become scientific dogma. A lot of what I’ve done over the years is actually going back and trying to prove that some of those things are incorrect and get us back on track to the correct path where we’re gonna solve the problem.” ~Dr. John Wallace

While Peter has tried his best to pinpoint the source of the problem, I argue he has come up short. Peter lacks a deeper scientific background and is obviously busy running companies and making investments. My brother, @biotechbrainbug, is not burdened with these tasks. Instead he’s burdened with a half dozen autoimmune disorders, one of which is so serious that it was the focus of an episode of House. In order to treat himself, and his diseases he was forced to learn and re-discover long forgotten truths. In his search he found a 1925 book, Science and the Modern World, written by Alfred North Whitehead.

“The progress of science has reached a turning point. The stable foundations of physics have broken up… The old foundations of scientific thought are becoming unintelligible. Time, space, matter, material, ether, electricity, mechanism, organism, configuration, structure, pattern, function, all require reinterpretation. What is the sense of talking about a mechanical explanation when you do know what you mean by mechanics? …[Science] must become philosophical.” ~ Alfred North Whitehead

Once again, the 1920’s calls forth to our current time. Is it a coincidence? Maybe, maybe not. To be sure, the 1920s was a monumental turning point in the history of the sciences, chief among them physics. Einstein messed up time itself in 1921. Quantum Mechanics stumbled in 1927 with the “triumph” of the Copenhagen Interpretation. Even the origins of modern science’s creation myth, The Big Bang, can be found in Alexander Friedmann’s 1922 equations.

Today, physics has been so completely hollowed out that its practitioners are mostly confined to either large and expensive experiments that offer zero relevant information or purely theoretical work that borders on mathematical masturbation.

Now I’m well aware of the magnitude of the claims I have just leveled at the foundation of modern physics and its current practitioners. I’m also well aware that the current practitioners are far smarter than I, but I will remind these smarter more intelligent people that it’s not being about being smarter; it’s about working smarter. After all, even a child can lift car with car jack. The leading physicists today are like musclebound weightlifters trying to lift a tank by their brute strength alone.

What I do know is that physics is not alone in its failures. Biology is no different. Unlike physics though, the world in which we live reminds us every day how flawed our current models for biology truly are. The current models are so wrong that they can’t explain something as simple as the sodium-potassium gradient of an individual cell.

The current theory is that we have little pumps on the surfaces of our cells that maintain a charge gradient. The simplicity of this theory suggests that it should be easy to verify or falsify. And it is. In fact, this theory was proven false over 5 decades ago by Dr. Gilbert Ling. And he found not one but three flaws with this model.

“The membrane-pump theory in general and the sodium pump theory in particular have been disproved because (i) the cells do not have enough energy to run the pumps; (ii) a healthy membrane sac (without cell content or cytoplasm) does not extrude sodium ion as the theory predicts; (iii) a cell assembly without functional cell membrane (and postulated sodium pump) maintains a steady low sodium-ion concentration like its normal intact counterpart.” ~ Dr. Gilbert Ling

So think about that for a second. Modern biology cannot properly explain how the cell, the basic unit of the organism, functions. Not only that, but it has ignored this fact for decades. And not only has it ignored this fact, it has also ignored the people who have discovered these contradictions for decades, leading our scientific luminaries to be largely ignored for their entire careers. Dr. Gilbert Ling died in 2019.

Furthermore, the way in which this sodium-potassium gradient is actually formed is due to water’s ability to form a 4th phase (shown below). This 4th phase of water exists between the solid (ice) and the liquid that was discovered by Dr. Gilbert Ling and later expanded upon by Dr. Gerrald Pollack.

Unfortunately, you probably haven’t even heard of this 4th phase of water. You don’t know how it works, how it forms, or why it is absolutely essential to the functioning of all life and unfortunately neither does modern biology. And now you can begin to understand why a virus can threaten the stability of our 21st century society.

The key to our future is not mindlessly building things that are based on a fundamentally flawed paradigm. The key is to design and discover a new paradigm that will drive the next hundred years of human innovation and growth. We have to re-think and to re-examine everything we were told was true. We have to learn for ourselves from the bottom up.

The answers are out there, buried in the shallow graves of the past. All we have to do is dig them up with the tools and technology our ancestors never dreamed of. I challenge you to do better.

I challenge you to re-think.