For market participants hoping for well coordinated intervention by central planners, 2016 has been a disappointing year. It’s also been an incredibly frustrating year for my sanity.

Whether it’s the back and forth flip flopping Fed, or the Japanese central planners who promise the moon and deliver next to nothing, I’m starting to wonder how much longer the markets are willing to tolerate this incessant teasing by central planners.

Recall that back in January, when the BOJ unleashed NIRP, the market’s immediate reaction was pure fear and the Yen actually rallied sharply. So it’s important to analyze the market’s reaction to any further shenanigans from the Keynesian Nirvana seekers also known as the Japanese central planners.

The best case one hears today is that “they’ll manage it”. Meanwhile, the Yen has whipsawed about more than a Michael Bay action film as the Japanese Government rushed together another stimulus package, this one according to Abe is over 28T Yen.

Size does matter, but it’s also a matter of how you use it. And only 1/4 of the package will go to actual spending over the course of a few years. Sure the deficit that has been negative for over 2 decades will expand, but it will not expand far enough to match the ridiculous 80 Trillion Yen/year bond buying program the BOJ has had in place for over a year now.

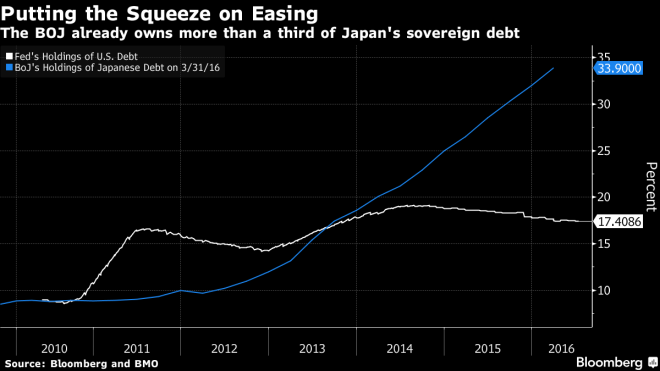

Once again it all comes back to the simple problem of supply and demand. The bank of Japan’s limitless demand is running into the problem of a limited supply of bonds. Back in May I wrote:

Thus the amount of JGBs truly available for purchase are smaller than people realize, which magnifies the BOJs current conundrum: Where are they going to find the bonds?

The answer is the Japanese government should issue a poop ton of debt by expanding the deficit even further with the BOJ monetizing every last bit. Unfortunately with Japanese government debt to GDP at +220%, it seems silly to think that the answer to Japan’s problems are for the government to issue even more debt.

With such a high debt level and such a large balance sheet, both the government and the central bank respectively have become limited in what they can do without creating doubt in their abilities to control the situation.

The BOJ is aware of the perception that it may be reaching its limits, which may be why the Japanese Government “reached” for the reins.

It is now apparent that the Japanese government was trying to force the Yen lower through a meaningless gesture of a weak stimulus package which has underwhelmed market expectations. The response was quite expected – a rallying Yen crushing the hopes of Japanese central planners.

How long before they are forced into Helicopter money remains to be seen, but according to Abe’s bleak opinion we may not be far off. From the May G7 summit,

“The global economic outlook is as grim as it was after the Lehman Brothers crisis in 2008, Shinzo Abe claimed on Thursday, as the Group of 7 revealed its stark divisions on economic policy.”

That’s a bold statement, to essentially say the world is on the edge of financial collapse. It’s arguably even bolder to not deliver on a significant stimulus package when one believes the risks are that large.

His fear is obvious, whether he is right or not remains to be seen. In the meantime we can all watch together as the strong Yen continues to undo all of Abe’s and Kuroda’s hard work.

Financial markets, especially these days, seem to be all about perception. Fortunately, not all countries are bound by the same perception that has shackled the Japanese central planners.

Take China for instance, where in the first quarter of this year the central planners launched a stimulus package of 10% of GDP over the course of just 4 weeks. Japan can’t even do a 5% stimulus package spread over a few years without drawing negative attention!

China of course, is the country that while simultaneously suffering capital flight has also experienced one of the fastest growing and largest debt bubbles in history over these past few years, and yet they can get away with massive stimulus packages. I can only imagine Abe’s outrage to such a ridiculous double standard.

Which brings me to the CNYJPY, an important but virtually unnoticed cross rate. The Yuan has been falling against the dollar these past few years, while the Yen has been rallying against the dollar which has led to very impressive decline in CNYJPY. So much so that the 50% fib retracement level off the 2012 low is now resistance going forward. ‘

Given the current pressures facing both currencies it seems hard to believe that this current downtrend will reverse. If CNYJPY crosses the 61.8% level, we should expect more risk off and deflationary pressures going forward.

It’s hard to see any of these events as bullish. And when you throw in the 1.2% US Q2 GDP growth, it makes me want to reach for the “fire everything button.” Instead, I will use this time to build my short position further via the purchase of +2 year duration puts on the S&P500.

-KC