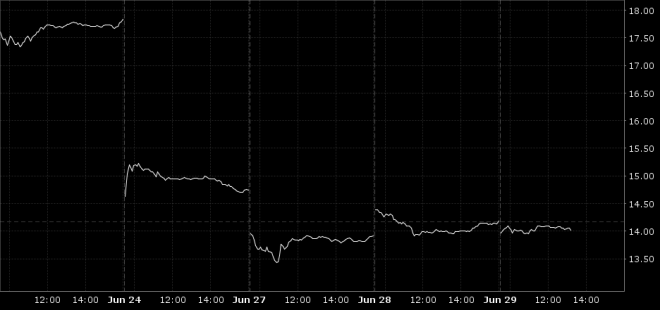

Another interesting market day. Don’t really have a comment because I don’t understand the price action. According to the S&P and the FTSE 100 the Brexit apparently never happened. It’s almost like their memories were erased…

I bought some more shorts after Brexit, and those have definitely not performed to my liking. It’s no secret that I’m bearish on the global economy. Just as it’s no secret that I’m scared of a huge black swan event.

My biggest fear is a mass liquidation and indiscriminate selling where all assets become directly correlated. I believe that it will happen, but I have no idea when. I’ve found it incredibly difficult to detach myself from this fear and as a result, until (if) my fears are confirmed I will be handicapped by said fears.

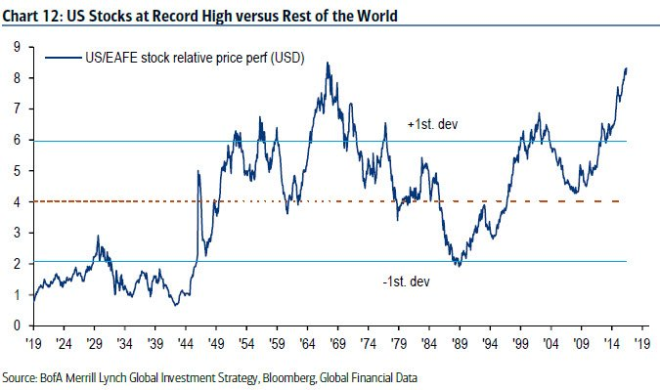

I understand that the US is the cleanest dirty shirt, and its banks are the safest in the world on top of having the most liquid asset markets on the planet. But that still doesn’t give me the confidence to go in and buy a Brexit dip when I see Deutsche Bank hovering near all time lows.

I understand the Chinese leadership doesn’t want to be blamed for the next global recession but when I see the Yuan making new lows against the dollar while the Yen simultaneously hits new multi-year highs I get very scared.

There have been multiple times this year, when my fear has prevented me from heeding my own advice and although one of those times I was battling the lovely cocktail made with one shot mononucleosis and two shots of lyme disease it still happened.

Recently, I read a very enlightening quote from Jesse Felder:

“I’ve found that… allowing macro concerns to prevent me from taking advantage of micro opportunities is a mistake.”

I learned that the hard way (oil in February 2016) and yet it took Jesse’s own words to solidify that for me. I still have my fears, but I’ve become a little more aggressive in seizing opportunities.

In order to combat those fears, whether rightly or wrongly I have only invested in companies whose long term prospects dramatically outweigh any short term declines. So much so that if any of these companies were to lose up to 50% of their value, I would have the confidence to step in and double down.

If you were wondering whether my investment personality is hedgehog or fox, the previous sentence should leave very little doubt. This frame of mind certainly limits the number of companies I can buy, but for a one man army, that’s not necessarily a bad thing.

To be fair, the majority of my funds are positioned based on global macro trends, and maybe I could sit back and call it a day, but when you are my size and have the confidence to find the right companies at a great price then you have to take a shot.