Ecks vs. Sever is an American-German film. It’s also one of the worst “films” of all time. I saw it when I was a boy and to be honest, I don’t remember the plot but the dueling spy film financed by Germans and Americans with the tagline “Your most dangerous enemies are the friends you’ve double-crossed” feels relevant to the tectonic shifts echoing back and forth across the Atlantic…

When I don’t know what to write about, I find myself looking at charts for inspiration. Given the one man nature of my operation, there’s always an interesting chart that I have overlooked, and this process of reviewing charts always leads to a revelation or two. The target of today’s conversation, is the Euro, but be warned, there’s a fair bit of geopolitical analysis in this piece.

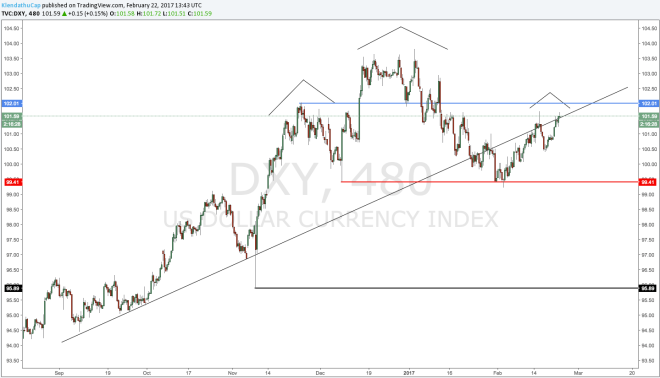

We have a broken 20 year trend-line. We’ll get to that interesting momentum divergence later…

A temporary bounce off at 12 year trend-line.

As well as a strong line of support around 1.05 with positive divergence in RSI momentum.

Add it all up and what do you get?

Back in December, I went tactically long on the Euro versus the Dollar. At the time my thought process was that sentiment was overly bearish (I could practically hear the screams for EUR/USD parity from my brother’s house in the mountains of Idaho). And despite years of record capital outflows, the Euro refused to break to parity.

Important to note that we’ve already begun to see a reversal in these capital flows. From the WSJ:

“Investors in the eurozone, for which data is more delayed, sold €15.99 billion ($17.2 billion) more in foreign bonds than they bought in the three months through November, becoming net sellers for the first time since 2012.”

As shown earlier, the technical back drop was also compelling, at least from a short term perspective. RSI momentum had turned bullish, while the Euro refused to make a significant new low.

Most importantly, inflation was finally on the rise and I thought that the monolithically slow ECB would be forced to taper faster than current market expectations. From Another Head Fake: Why The Euro Is Headed Higher:

“Imagine inflation hitting 1.5% over the next few months with an accelerating trajectory. In spite of the ECB’s QE, long term rates could begin to rise, and we would start to hear rumblings of a potentially accelerated taper out of the ECB further pushing rates European sovereign rates higher.”

Turns out, I was wrong. Inflation in Germany accelerated to 1.9% in January.

German CPI (YoY)

Luckily I was generally right, rather than precisely wrong like Draghi was.

Meanwhile, as of writing this article, the 10 year German Bund is offering a paltry 41 basis points of yield. Inflation has gone too far, forcing a stern response from German Finance Minister Schauble. From the FT:

“The euro exchange rate is, strictly speaking, too low for the German economy’s competitive position,” he told Tagesspiegel. “When ECB chief Mario Draghi embarked on the expansive monetary policy, I told him he would drive up Germany’s export surplus . . . I promised then not to publicly criticise this [policy] course. But then I don’t want to be criticised for the consequences of this policy.”

So to me, it seems the ECB has some ‘splaining to do. They have to sell NIRP to those “poor” German savers who are fighting 2% inflation. Clearly they aren’t selling it well. Support for Merkel’s Euro-centric party is waning.

Unfortunately, these are the sacrifices the northern creditor nations will have to make in order for the European project to succeed. The southern states simply owe too much debt. The only political remedy to said debt burden is devaluation through inflation and financial repression.

This puts the states of the EU at odds with one another and unfortunately this is the part where I get into some nasty geopolitical analysis, for the European Union is not an economic project but a political one. For those uninterested in my geopolitical analysis skip the following section denoted by the horizontal lines (apologies for the length):

“To combat the call of sin, ie., Resistance, the fundamentalist plunges either into action or into the study of sacred texts. He loses himself in these, much as the artist does in the process of creation. The difference is that while the one looks forward, hoping to create a better world, the other looks backward, seeking to return to a purer world from which he and all have fallen.” ~ Steven Pressfield

From the 1500’s to the dawn of the 20th century, the European nation state reigned supreme on the global stage. Through superior technology and capital pooling capabilities, these small countries were able to build empires on which the sun never set. But in the last 100 years, with the emergence of the supranational powers of the US, Russia, and most recently China, these countries have slowly faded into the background. In order to compete, the nations of Europe needed to band together, forming their own supranational organization, the European Union.

And yet, from the lens of global significance, the EU has been an unmitigated disaster. What started off as an interesting idea, quickly became a dying man’s last gasp for glory. With flattening population growth, a stagnant economy, and widening inequality, the European Union gives trashcan fires a bad name.

Already under tremendous pressure, the migrant crisis is not the final straw but the ten ton elephant that broke the camel’s back. At first these people lost their voice on the global stage. Then the bureaucrats from Brussels, took their voice in European affairs away. And now finally, they see the migrants as a threat to the last thing they have left, their national identity.

As Rahm Emanuel infamously said, “A crisis is a terrible thing to waste” and populist leaders have seized on this opportunity, promising their growing base a return to their nation’s imperialist glory (my emphasis in bold):

“The aim of this program is first of all to give France its freedom back and give the people a voice,” ~ Marine Le Penn

The people have lost their voice. They have lost their country. But now they have the opportunity to take it back. It doesn’t matter whether or not these people are good leaders they are saying all the right things to get elected. To turn the clocks back a bit and egotistically highlight a post I wrote back in November 2014 titled Desperation: Why We Will Continue To Elect Awful Leaders:

“The point is that it has become exceedingly obvious that politicians no longer have to be good at their job to get elected. They can skate by on big promises, grand statements, and “not doing stupid shit”. Of course these are terrible qualities to have in any human being let alone an elected official…”

This was the Trump playbook. Recall Trump’s main goal for the presidential debates was to not come off as an insane ego-maniac, while along the way promising everyone something: the resurgence of coal to West Virginia and Pennsylvania, the border taxes on foreign imports to the midwest, the repeal of Obamacare while maintaining coverage for all, etc… etc… And now like a New England Patriots coach, the populist candidates of Europe have stolen his playbook. The following is an excerpt from Reuters (my emphasis in bold) describing Le Pen’s “manifesto”:

“It says a generous policy of tax cuts and welfare increases would be made possible by fighting social security fraud, tax evasion and changing tack on the EU and migration, but without explaining how that would be done.“

Tax cuts, increased welfare, no migrants, oh my! What a plan! How can anyone compete? Seriously? No explanation? Who cares! It all sounds so fantastic. Let’s have our cake and eat it too!

Status quo politicians cannot hope to promise as much as these rising right wing candidates can simply because the public has little to no trust in them. The status quo has failed to deliver on their campaign promises for decades as the middle class in developed economies has slowly been hollowed out. Most people in the US saw through Hillary’s phony promises in a heart beat, but Trump, they gave him the benefit of the doubt.

And in case you had any doubt, on the public’s level of trust in the status quo politicians versus these populists politicians, look no further than the French election. Francis Fillon who is arguably the best candidate (from an economics perspective) has been accused and will likely be indicted on charges of graft and misuse of state funds. From the NY Times:

“Mr. Fillon’s campaign was thrown into turmoil last week after Le Canard Enchaîné, a weekly newspaper that mixes satire and investigations, reported that his wife, Penelope Fillon, was paid with taxpayer money for a bogus job as a parliamentary assistant to her husband and his deputy in the National Assembly, the lower house of Parliament.”

Interestingly enough, Le Pen is under investigation for THE EXACT SAME BEHAVIOR and yet no one gives a shit. From the same NY Times article:

“Ms. Le Pen is facing her own allegations of financial misconduct at the European Parliament, where her party is accused of paying its staff members with European Union funds, which can only be used for parliamentary aides. Ms. Le Pen is refusing to repay the €300,000 that the European Parliament is seeking to recover.”

So once again, I must ask how are the status quo politicians supposed to compete with candidates who can promise the moon while simultaneously getting away with political suicide?

Given everything I’ve said, I believe the odds are quite high for a right wing nationalist to win a major election this year, whether it be the Dutch in March, the French in May, or the Italians in the summer. If just one of these dominos falls it could set off a chain reaction leading to the break up of the EU.

BACK TO MACRO (sort of)!

I believe the geopolitical risk I have outlined has begun to be reflected in the breakage of the 20 year upward trend-line.

So despite the positive momentum divergence, I do not expect this to be an important bottom that will give way to another sustainable push higher in the Euro. Like my previous post said, I believe this move to be a #HeadFake.

But given the inflationary pressures there’s still room for rates in the EU to push higher before their economies start to suffer from any tightening. Recall that interest rates were sub 1% out to 20 years in some EU states.

On top of being trapped in the same deflationary spiral the rest of the world finds itself in, the EU has been dealing with a series of rolling crises that has not allowed these economies to build any sort of momentum that would lead to significant investment. In short the European economies are starving for more investment. Higher rates will spur the banks to lend and that investment because of the prolonged drought will have outsized effects.

Unfortunately, the same cannot be said about the US, which has been growing somewhat consistently since the GFC. Perhaps more importantly, the US, despite what Trump says, does not suffer from a lack of capital investment.

https://twitter.com/Valuetrap13/status/828319139378892800

https://twitter.com/Valuetrap13/status/828320124088225797

So far, the only thing higher US rates have achieved (other than rising bank stock prices and a stronger dollar) is a tightening of financial conditions for the US consumer who has been struggling under a massive debt burden.

It won’t be long till the other more connected sectors such as the auto or housing sectors feel their wrath. While Europe will benefit from rising rates, the US will not. And because rates pushed higher in the US first, the US has already begun to feel these negative effects. I expect this divergence to continue further compressing the spread between US and German interest rates, which is the major driver of the Euro versus the Dollar.

But despite my bullish short term disposition on the EUR/USD, there still remains quite a bit of overhead resistance. The thick bold line, is the 20 year trend-line. We could break above it temporarily, as nothing is set in stone, but in the end, given the geopolitics of the situation, it won’t be long till we see the Euro go much much lower.