I’m a twenty something millennial, and like a lot of those on Wall Street and or in finance, I lack the experience to tell me that this recent move in risk assets is a trap… but that doesn’t mean there is a lack of evidence I can put forth to support my hypothesis.

After all, if it looks like a trap…

If it smells like a trap…

And if it sounds like a trap…

![]()

Well if the OECD says it, it must be true. I guess anything is better than the level of governance the US and indirectly the world has suffered under these past 16 years. We finally have a business friendly president in the White House who respects state’s rights. You can practically feel the collective sigh of relief out of Wall Street. And yet, I must remind them that President Obama was terrible for business but great for stock prices, is it so hard to believe that the opposite be true under business friendly President Trump?

The “Trumpflation” narrative is a paradoxical joke that ignores history and common sense. The idea that Donald Trump can quickly end the political gridlock that has strangled our nation for so many years is akin to the same euphoria that marked the end of tech bubble. Donald Trump, is a deal maker, and a persuader but historically speaking, he’s early. Alexander Hamilton had already mapped out the future republic of the United States at the close of the revolutionary war in 1783, but it wasn’t until 1787 that the US Constitution was actually created and it would take another 2 years after that for it to finally be ratified.

Donald Trump much like Alexander Hamilton has promised drastic change in a time of hidden crisis. To these men it was clear that the final battle had not yet been fought, but the majority of the population did not share their sentiment.

In order to win the election, Donald Trump successfully united a diverse group of people and yet he didn’t win the majority vote. And although the republicans may have won congress, Donald is hardly a republican president. Donald Trump is akin to a battle commander who has charged too far ahead of his troops. He will need to wait to gather the army before he can launch an effective attack. I have little doubt that Donald will bring about much needed change in time, but rescinding some executive orders will only tickle the status quo.

The odds that the New Deal 2.0 will arrive later than current market expectations is high. Of course that $1T stimulus over 10 years would amount to a pittance regardless. The US government owes $20T of debt, what’s another $1T over 10 years, really?

One only needs to look to Brexit, to see the folly of the current “Trumpflation” euphoria. The action passed with a narrow vote and now remains in perpetual limbo. The situation is a bit different with the incompetent and poorly designed EU at the other side of the negotiations but has the US Congress shown to be much different over the past 8 years?

Remember when a democratic president with a majority in congress could barely pass the disaster that is the Affordable Care Act? Now there is reason to hope, and perhaps after I put ink to paper, the Democrats will push Pelosi out of her leader position ushering in a wave of unexpected change. But I’m not holding my breath.

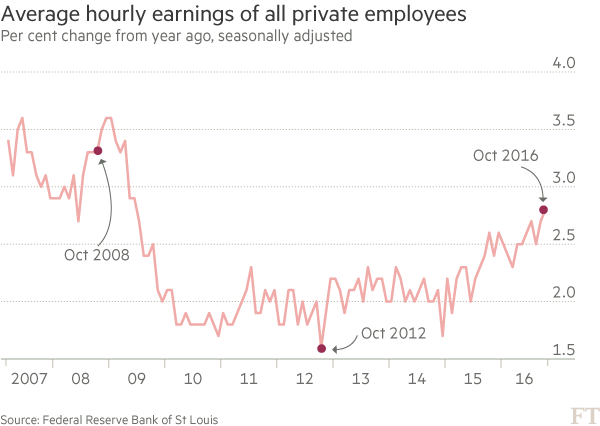

As I have said before, the market has likely gotten ahead of itself. Perhaps I’m overestimating the narrative’s effect on surging inflation expectations and should more attribute such a move to China’s rising inflation (and I will do just that later in the article). But interest rates in this country have risen to the detriment of all those who owe debt.

History continues to rhyme as investors once again get sucked into yet another transient spout of “rising inflation” near the end of a credit cycle. The problem with rising inflation is that it pushes up interest rates which prick the credit bubble that Fed was brewing. Mortgage rates have spiked sharply in the wake of the election.

Which in turn hurts demand for mortgages.

The following from Wolfstreet,

“…for the national median home, priced at $232,200, with rates going from 3.57% to 4.5%, costs would rise by about $1,200 a year. If rates hit 5%, costs would jump by about $1,900 a year. For households on a tight budget, these additional costs would turn into an impossible squeeze.”

This unexpected belt tightening comes at a time when American households are incredibly sensitive to rising costs. According to the lovely WaPo,

“About 46 percent of Americans said they did not have enough money to cover a $400 emergency expense. Instead, they would have to put it on a credit card and pay it off over time, borrow from friends or family, or simply not cover it at all.”

One can only imagine the pretzel shaped box rising mortgage rates will force American households into.

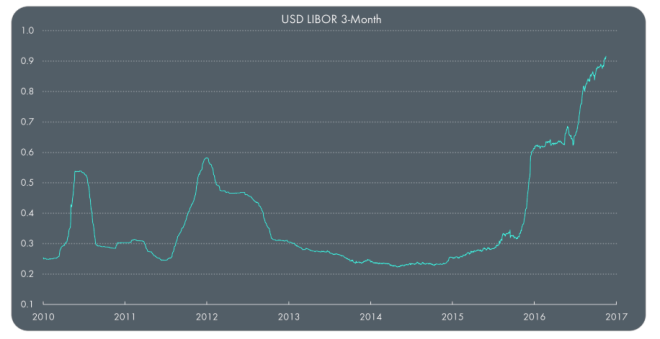

But mortgage rates aren’t the only interest bearing debt that is rising. 3M Libor has been rising steadily for over a year now, even after the regulations were put in place in October – RIP 2a7 Regulation Narrative.

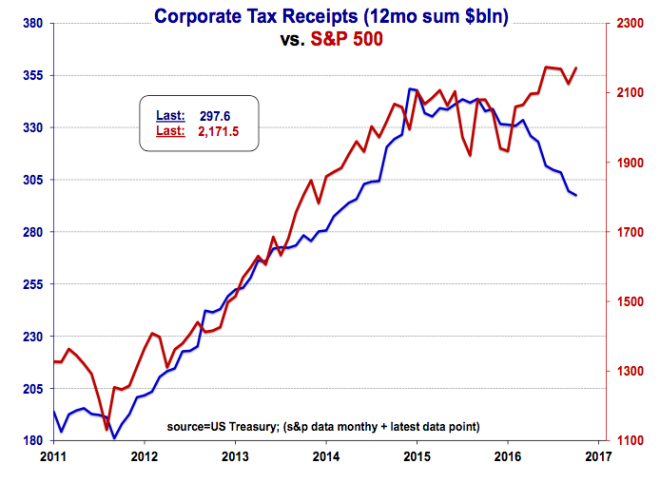

As bank borrowing costs have steadily risen through out the year, one would think the value of those banks would fall, but not in the Utopian narrative of Trumpflation where all is great, yuuge and tremendous.

To be able to trade this market, one is forced to employ the George Costanza method of trading.

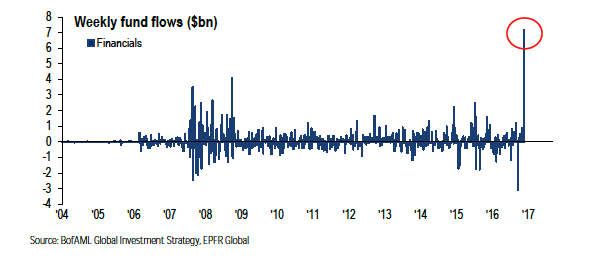

Of course I’m only joking. But for those managing money, whose ranks I’ll be joining early next year, this is no joke. Unsurprisingly, hedge funds have continued to get creamed by these paradoxical moves which has further accelerated the push to passive.

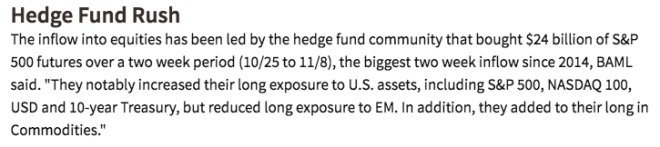

It appears they have all had enough of trying to out think the market and simply bought any and every asset as long as it was denominated in dollars, including US treasuries.

But is now the best time to go long US treasuries? I hate to break it to them, but they aren’t the only ones trying to catch this falling knife.

On a rate of change basis the move in treasuries has some room to run.

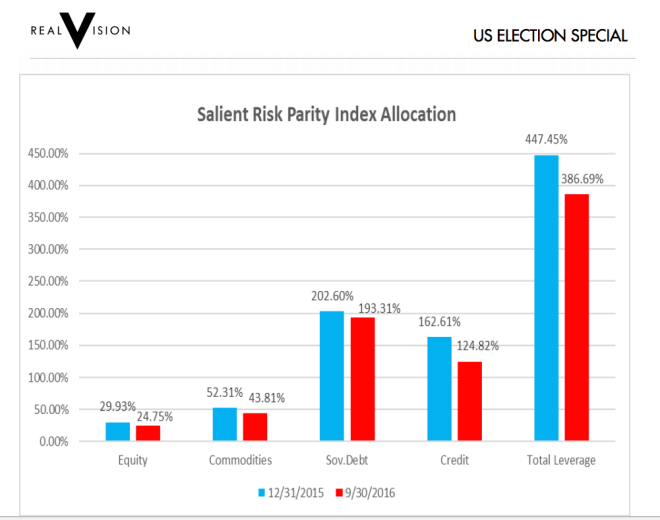

Of course the slow moving risk parity funds that have piled more and more into US treasuries have also been slow in unwinding their levered positions.

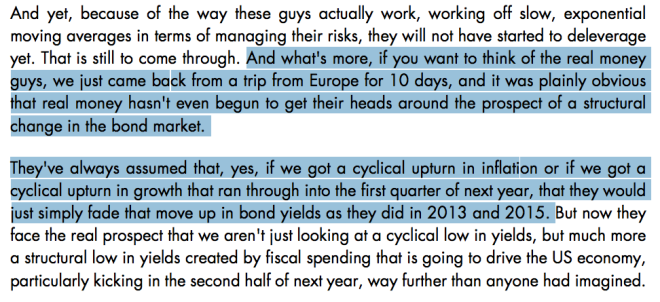

And of course, I always enjoy a good anecdote from a trusted source, in this case Julian Brigden.

Now I may not share Julian’s views that the “cyclical low” in yields is officially behind us, nor do I buy that this is in fact a structural change in the bond market. As I have said previously, I’m on the side of transitory spike of inflation that catches the markets and investors off guard and pushes the world into a deflationary crisis. Given the record low bond yields and investor positioning we saw over the summer, I’d say this hypothesis is still on track. That’s not to say that this head fake cannot be very large, but I must stress given the fragility of the global economy, it’s hard to imagine this inflation push not leading to some kind of global financial crisis.

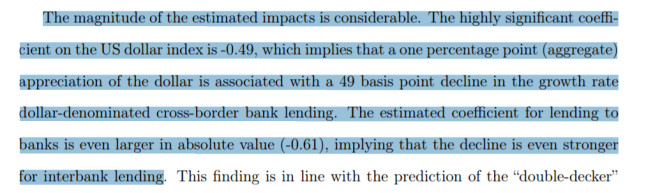

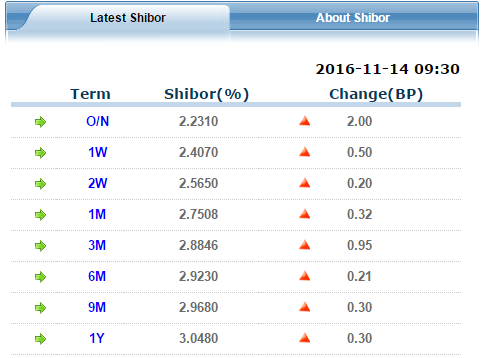

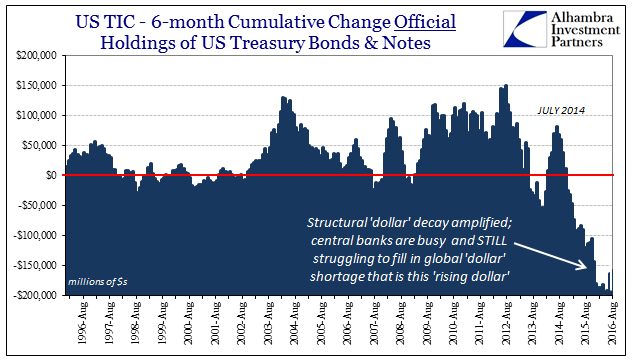

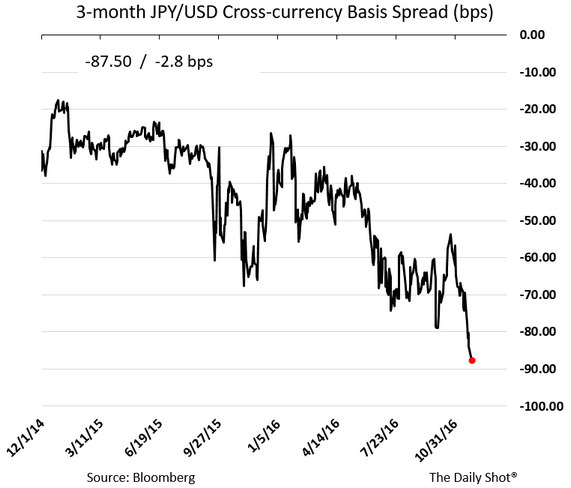

The rising US interest rates have driven the dollar higher, creating a dollar short squeeze around the globe. Entities that borrowed cheap dollars will get clobbered as the dollar continues its rise. Despite investors closing their eyes, pinching their noses, and screaming La-La-La-La at the top of their lungs, currency and credit risk have continued to exist. They say an image is worth 1,000 words, this one I like to think is worth 1000x.

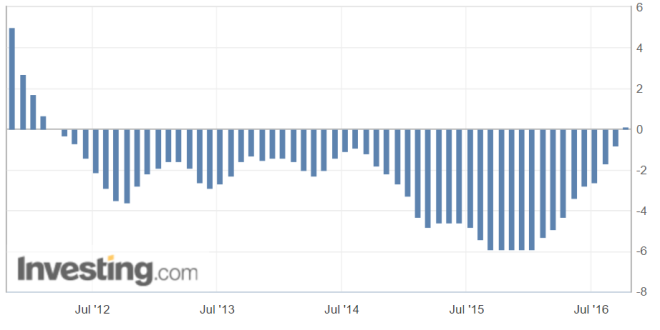

Plunging cross-currency basis swaps indicate this dollar shortage has begun to accelerate.

This dollar shortage is like a virus that turns the body’s cells against it. The longer it persists the larger it grows. And ever since the virus entered China, the global economy has been running on borrowed time.

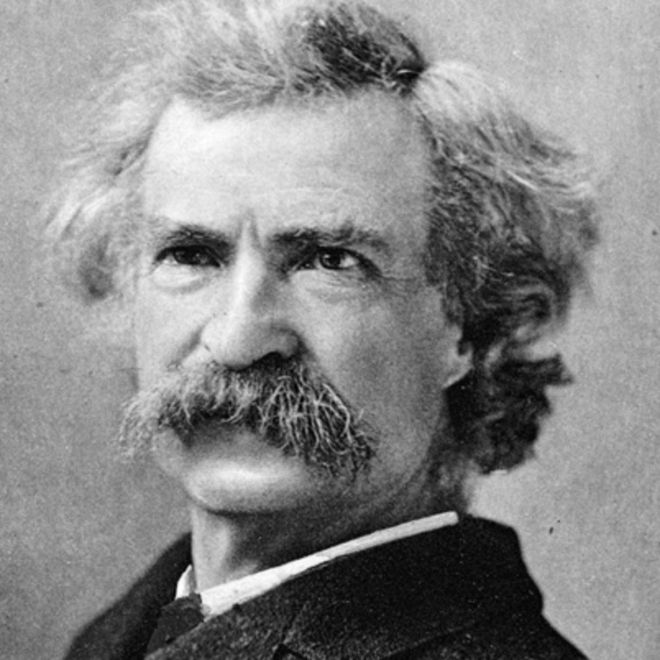

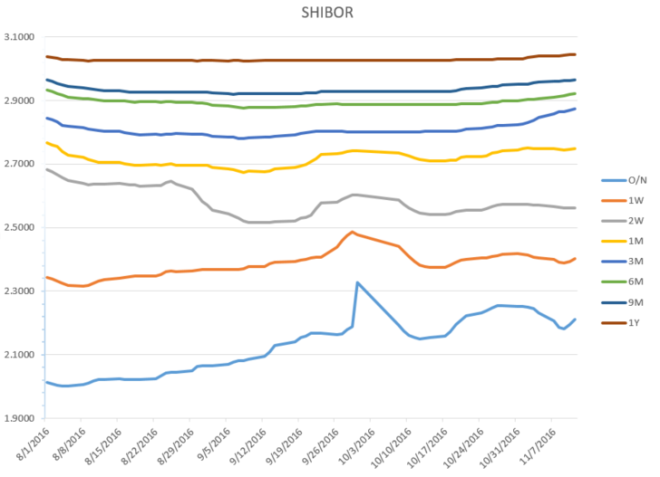

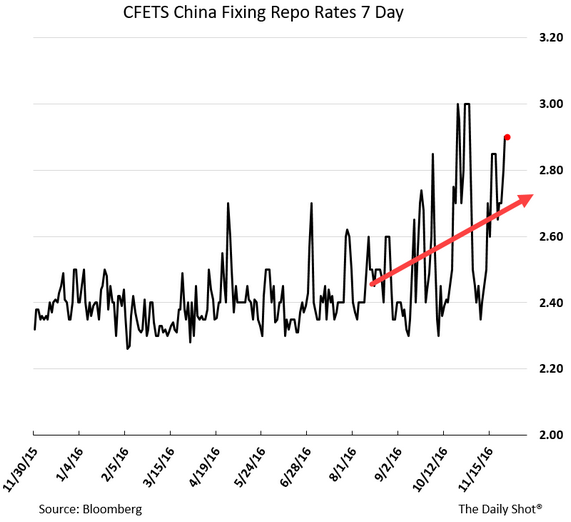

All durations of SHIBOR have risen steadily the past 13 days, further tightening liquidity in the country.

It was only a matter of time before these conditions prompted a response from investors…

Quoted by Bloomberg, Wu Sijie, bond trader at China Merchants Bank said “tightening interbank liquidity and the expectation of even higher short-term borrowing costs are driving up swap costs and affecting sentiment on the cash bond market.”

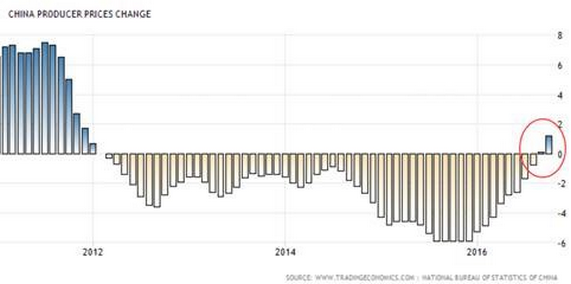

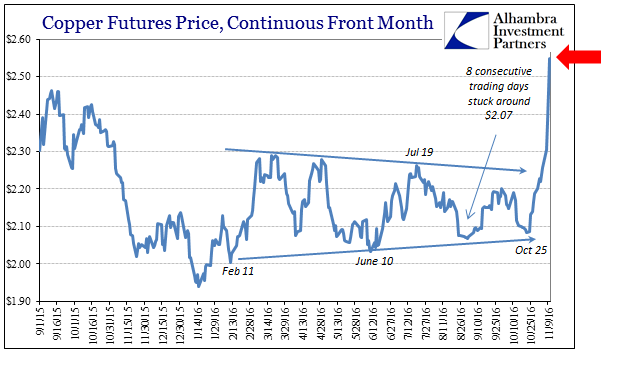

And those expectations are are likely justified given China’s rising inflation. Inflation that is rising because the government tried to engineer a bottom in a credit cycle through a massive stimulus push. China has added over 45% of GDP in debt this year alone, but due to the declining availability of productive investments, the lion’s share of this stimulus found its way into speculative investments such as housing and commodities. Commodities have done particularly well in China this year which has helped fuel the rising inflation and push interest rates higher. And higher interest rates have tightened liquidity, threatening to pop the speculative commodity bubbles.

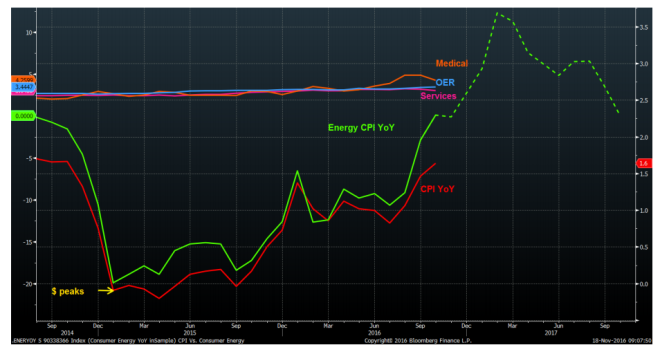

This correction could be temporary but it would be foolish to assume that these parabolic moves in commodity prices were not only sustainable but entirely devoid of consequence. 2016 was a lost year for the Chinese economy and yet the leaders in Beijing continue to believe that they control their own destiny. But as they continue to close down other channels of capital outflows, it risks trapping this inflation in China and further destabilizing the country. As Julian Brigden’s model shows, China in less than a year has gone from deep deflation to surging inflation.

This inflation will be exported to the rest of the world pushing yields higher and hurting all those who owe debt. The rising dollar should dampen the inflation China exports to the US, but still, on margin that inflation is rising and will likely continue to push bond yields higher for the short term.

Let’s not forget the impact rising oil prices will have on inflation around the globe. This time last year oil was trading in the 30’s, but as of writing this article, it appears OPEC has agreed to a production cut in concert with some non-OPEC members. The blood bath in fixed credit appears to have only just begun.

Perhaps no place on earth is less prepared for rising inflation than Japan. Where the BOJ has pegged rates to the floor. It will be interesting to see how they respond to these pressures with the Yen in free-fall. Like all pegs, I expect this one to be broken.

Europe is not to far off Japan’s predicament either, with negative rates and a central bank expanding its balance sheet like a mad man, they too are incredibly susceptible to surging inflation. Of course I’m ignoring and glossing over the myriad of problems baked into the continent’s politics…

…as well as it’s banking system.

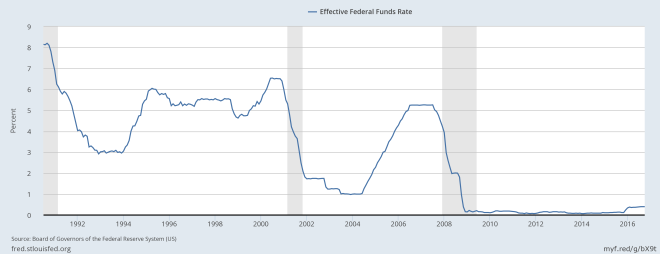

If we go back to the prior crises, of the last few decades we’ll note that they all started with a spurt of inflation followed by severe deflation. In this case I’d like to use the 1998-2000 example. In response to foreign shocks of the Asian financial crisis and Russian Ruble crisis, the Fed eased. Once the shocks subsided, the Fed began to tighten, which pulled capital into the US and pushed the dot com bubble to historic highs. I think we are witnessing a similar event but with important differences.

In response to a foreign shock (the Yuan devaluation), the Fed eased (stopped its rate hike cycle). That pause, allowed for inflationary pressures to build up, while simultaneously pushing interest rates lower. Now, with those inflationary pressures too high to ignore, the Fed is forced to hike. But the foreign shocks that put the Fed on pause never went away and have only grown larger.

Although we are likely in the blow off top phase of US equities, the duration and magnitude of this phase will be dampened due to the abnormally high amount of foreign land mines just waiting for the Fed to step on. If the typical blow off top phase is 18 months, we maybe have 9-12 months which started in early November. I remain open to other possibilities but until new information comes to light, I leave the last word to Admiral Ackbar.

Correction: the Revolutionary war ended in 1783 not 1983. The constitution was written in 1787 not 1987.