It looks as if the chances of a decent Jobs number on Friday just went down. A host of negative US economic data came out today and not much of it is pretty.

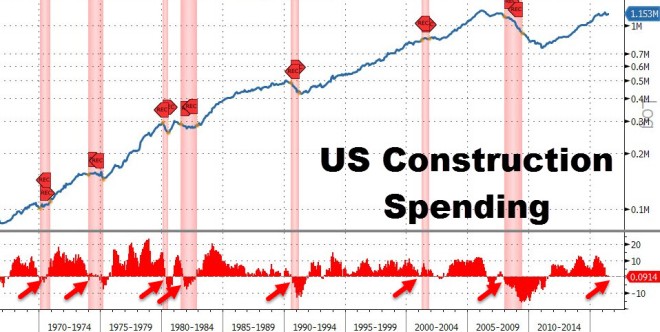

Construction spending fell for the first time since the crisis.

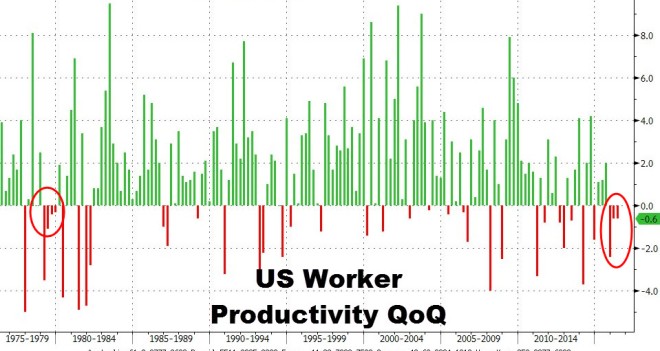

US worker productivity continued to decline.

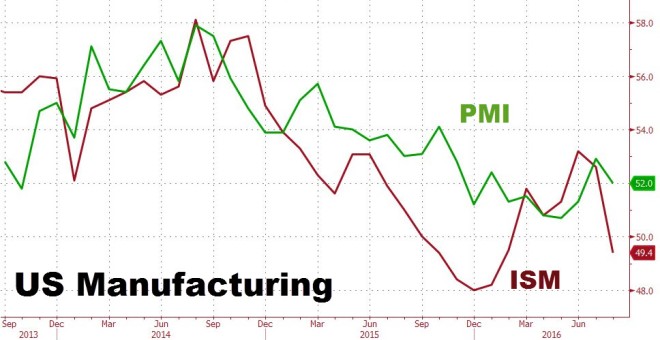

ISM fell back into contraction territory.

Apparently the US election is starting to show up in the US economic data. Businesses are pulling back in the uncertain environment. But that still doesn’t stop the Atlanta Fed from predicting US GDP growth in excess of 3%. I expect this number to come down by quite a bit. Remember at one point in time, the Atlanta Fed had predicted 2.8% GDP growth for Q2 2016 before revising it down to 1.1%.

Needless to say, the Fed won’t have trouble coming up with an excuse not to hike interest rates this month. The fact that August is normally a weak month for job growth as well, only increases the odds that the NFP number will be underwhelming, thereby allowing the Fed to back out of its recent calls to action.

https://twitter.com/edwardnh/status/771362361697570816

I tend to agree with Mr. Harrison. I don’t think the Fed will seriously consider hiking unless the number is +300k. The market has different standards and will most likely interpret any number above 180k as a positive for a potential rate hike. But once again I must stress, in lieu of recent economic data, the odds of the number being in excess of 180k have fallen.

The recent move in dollar strength/yen weakness may be ending sooner than I originally thought. But that’s not all. US equity volatility is once again on the rise. After an incredibly quiet summer, traders are coming back to their desks and staring at a Fed that wants to hike, slowing economic data, and a very uncertain US election. Strap in, things are about to get interesting!