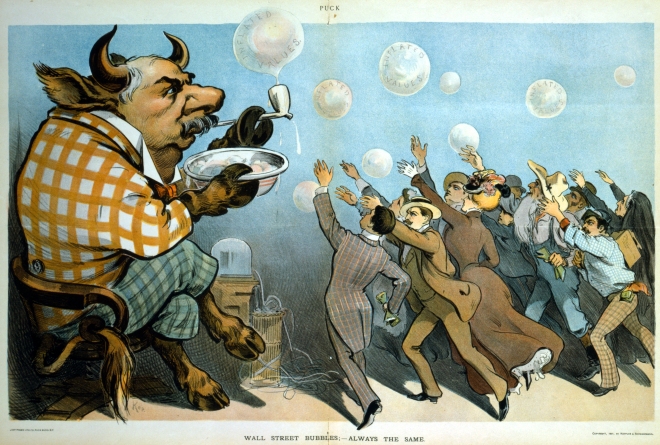

Panic has entered a bull market, and in a bull market, you want to buy early and reap the rewards. It is no longer good enough to be standing near the exits. It’s time to get out of the theater. Go outside and sell people some safety. The show is over…

And central bankers know it.

The market is under this false narrative that the market is not tight enough to force Yellen to ease. Read the excerpt from her statement yesterday and tell me she doesn’t believe financial conditions warrant further easing.

“As is always the case, the economic outlook is uncertain. Foreign economic developments, in particular, pose risks to U.S. economic growth. Most notably, although recent economic indicators do not suggest a sharp slowdown in Chinese growth, declines in the foreign exchange value of the renminbi have intensified uncertainty about China’s exchange rate policy and the prospects for its economy. This uncertainty led to increased volatility in global financial markets and, against the background of persistent weakness abroad, exacerbated concerns about the outlook for global growth. These growth concerns, along with strong supply conditions and high inventories, contributed to the recent fall in the prices of oil and other commodities. In turn,low commodity prices could trigger financial stresses in commodity-exporting economies, particularly in vulnerable emerging market economies, and for commodity-producing firms in many countries. Should any of these downside risks materialize, foreign activity and demand for U.S. exports could weaken and financial market conditions could tighten further.” ~ Janet Yellen

As head of the Federal Reserve, Janet Yellen has immense and diverse powers that most people aren’t factoring into their interpretations of her speeches. If Yellen were to tell the Chinese that their banking system is insolvent and their economy is going to collapse, what do you think would happen? There would be a bank run, China’s economy would collapse, and the CCP would blame the US and declare Yellen’s speech an act of economic warfare.

The truth doesn’t just hurt, it brings the world’s second largest economy to its knees. And it could do that to almost any other major economy as well. So if you were expecting Yellen to spell out in plain English that the world economy is on the verge of a depression, then I’d take the top out of your pocket and watch it spin for eternity. Come back to reality where what should happen and what actually happens are two very different things. Yellen speaks in what is commonly known as Fed speak. And in Fed speak, Yellen is telling you that she knows the world is in serious trouble.

To make matters worse, she knows they are out of ammo. So what is the Fed doing? They are out making bullets for the next battle.

Unfortunately, the Fed is learning hard way that you can’t make something for nothing. Those bullets have a cost. Each rate hike sucks the global economy of dollar liquidity that it is so desperately hooked on. In essence, Janet Yellen is destabilizing the global economy so that the Fed has more tools to help the US. If that doesn’t tell you every central banker for him or herself, than I don’t know what does.

If the Fed could ease they would, but a 25 basis point cut will not help the economy and only signal to the world that the Fed doesn’t know what it’s doing. Now I’m not saying they won’t cut, but I am saying that any rate cut won’t have the same effect that the market hopes it will.

Even a negative interest rate cut would have profound implications that I don’t think people are taking into account. We’ve seen what gold does in a falling rate and dollar environment. If the Fed goes NIRP, gold will shoot through the roof and the Fed will lose credibility that way. So if the Fed does cut, the market may be happy at first, but that elation will turn to panic when the market realizes the implications of the Fed reversing course.

That leaves QE, which to me isn’t an option in an election year. The Fed knows that QE has very little effectiveness but even less without increased fiscal spending in tandem. In an election year, in the final year of his reign, the odds of Obama passing a huge fiscal spending bill are slim to none. So the Fed if they choose to launch QE will have to be without the aid of fiscal policy, knowing full well that QE4 will not be effective. Which leads me to believe that they will not openly launch QE4 this year in the absence of a serious stock market crash >35% and a US recession.

The Fed isn’t the only one under the gun, for now I’ll just talk about the BoJ, who have proved quite inept and keeping their carry traders alive. The BoJ cut rates to negative and the Yen strengthened over 7% in 7 trading days. USDJPY at the time of this article is trading with 111 handle. The carry traders are getting killed right now, and this trade will only get worse as it unwinds. The BoJ may be forced to print Yen and sell them on the spot market to devalue the currency and delay the inevitable.

I doubt the BoJ will be going any further negative especially considering the negative rate cut was a vote that was barely passed at 5-4. Once again though, I could be wrong, but even if I am, I think at this stage, any further rate cuts only further destabilize the Japanese banks and its economy.

If you hadn’t noticed yet, central banks are impotent, and the market is very slowly discovering that fact. When the market does, all hell will break lose. Take advantage of its blindness.