I’ve noticed a trend in my recent articles, where I start on one topic and usually end up talking about three other things instead. Using the it’s not me, it’s you argument, I’m going to blame this on the global economy for being so damn fragile and interconnected. With that said let’s get on with not answering the $10T question.

Anyone who saw The Big Short or were contrarian enough to have actually read the book, will know that the men who lead the charge against the US housing bubble opened themselves up to a vast swath of criticism and ridicule.

So it’s not surprising that the mainstream, other investors and least surprisingly of all China are all criticizing and ridiculing the likes of Kyle Bass, George Soros and Mark Hart for their positions against the Yuan and indirectly, China’s economy.

PBOC governor Zhou came out with a very solid interview the other day. It was so good, that the market actually believed him, and maybe it was to be expected. The PBOC hasn’t given the market enough to doubt its omnipotence.

The biggest bubble of them all is the one in central banking competence. Maybe I gave the market too much credit (the CCP certainly does (get it?)), or maybe Zhou’s speech really was that good, perhaps we are looking out the makings of a Draghi 2.0.

Unfortunately, Draghi has shown to be quite limited. The Euro is strengthening, the economy is imploding, and the stock market is crashing, all whilst embarking on QE and negative interest rates with a threat of future cuts.

But back to Zhou, what did the market expect him to say? “Please don’t speculate”? He pretty much told the world in a very calm and commanding manner that #everythingisawesome.

And if #everythingisawesome, and China’s banking sector is fine, then capital will stop fleeing the country in record amounts once people realize that everything going on outside of China is actually relatively even worse.

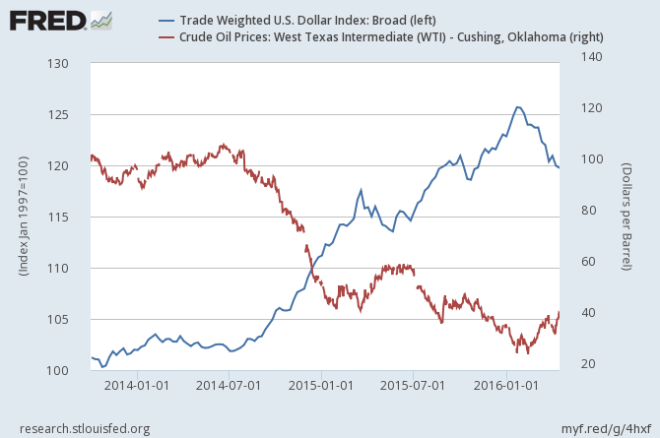

We live in relative world, and maybe China stands up longer than Europe or Japan do, but if their struggling, what does that mean for the US? The US’s recent struggles have been well documented and suggests an even further slow down, which will be an even further drag on global dollar liquidity. Given the shrinking dollar liquidity that will result from a slowing US economy coupled with a tightening of Fed monetary policy, EMs will be under even more pressure to tighten their economies to prevent even further capital flight.

Which then comes back to China and their ridiculous credit bubble that seems to have taken the game to another level as of late. How long will that last? And that’s the $10T question isn’t it. Because a bet against the Yuan is essentially an attempt at picking the top in a multi decade bubble. So if Mark Hart, Kyle Bass, and George Soros are met with resistance, some of it must be attributed to the belief that “who are you to be able to call such a peak”?

Many have come and gone before claiming China’s over-investment is unsustainable. Many have noticed China’s excess and ghost cities way back in the early 2000’s. And Many have been wrong. It’s 2016 and China is still churning out record amounts of credit.

This isn’t the first time Kyle Bass has tried to call the top in a multi decade trend when he shorted JGBs back in 2012. He looked at the problem logically and saw a confluence of negative factors that no central planner could solve. Japan at the time had and in most of these cases still has the following: declining demographics, declining or stagnant GDP growth, rising debt growth, zero inflation, and a trade deficit due to Fukushima.

The fact that Japan has limped on for 4 years since then is sign of just how hard it can be to call the turning points in multi-decade trends. Kyle’s short JGB thesis was built around the idea that Abe would be able to push inflation to 2%. As the world, Yen carry traders and Kyle Bass have now learned that central bankers actually cannot get inflation up with their current set of tools.

The idea was based on the belief that lower interest rates would spur people to lend more money to get a better return. Theoretically as the risk free rate reached zero, there should be no incentive to hold it. But we live in relative world. And at this point in the game, people would rather pay for safety ie. negative rates, or sit on the sidelines rather than go any further out on the risk curve. In essence, investors for the time being, are tapped out.

And this is why Kyle Bass was wrong on Japan. Central banks cannot create inflation with QE or NIRP. Because what are those tools doing? Front loading demand. And when you front load demand, you get a quick spark on inflation but nothing that is sustainable, because once you get to the future and realize that there’s no demand there, you get deflation. Well we are living in that future, so what do we do now? Continue to borrow demand from even further out?

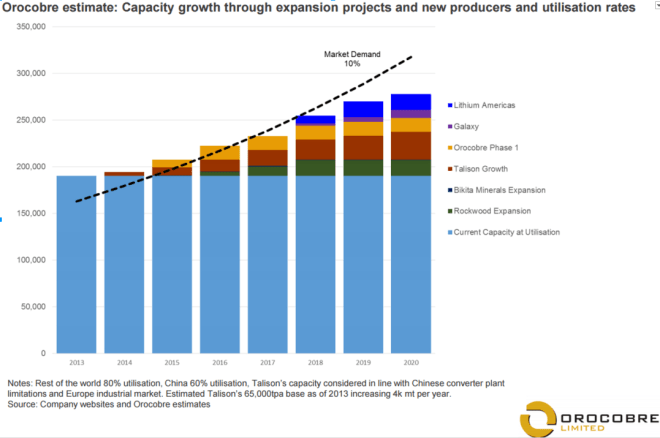

We are witnessing the limits of the current monetary policy tools. As debt levels rise, it takes even more debt to generate growth. Which is why we come back to China, where judging by the chart below, no nation understands this better.

Over the five years immediately following the GFC, China’s banking system went from $9T to $24T, an average of $3T a year. In the last 2.5 years, China has added over $12T to the banking system bringing it to $36T, an average of $4.8T a year,

If January is any indication, China is set to continue with its massive credit growth. For the month, Chinese banks generated a whopping $500B in new loans. To put that to scale, China’s banking sector added more debt than the GDP of the entire country of Norway.

China has known for a long time that in order to keep the game going they have to issue exponentially greater amounts of debt to keep the economy afloat, which to be quite honest may be possible for a little while longer. It is a little difficult to say when. Akin to Japan, this has been going on for decades. To call a top after 20 years is quite difficult as Kyle Bass well knows.

However, that doesn’t mean there aren’t visible catalysts out there. The most obvious is the capital flight. China has lost $1T of FX reserves at an accelerating rate. But with $3.1T remaining, China does have some time before it burns through all those reserves.

Now the most common argument is that $1T of those reserves are in illiquid assets, which if you can believe China is not true. If those FX reserves were illiquid they would not be able to qualify as FX reserves according to the rules of the IMF. So if we assume that China has a $4T in funds left, then they can maintain capital outflows for at the very least a year, if not two.

Two years is probably more than the EU has before their next banking crisis. Right now Italy like China is having its own NPL problems. The Italian government would love to clear that debt off the balance sheets through a devaluation of the Euro and other such measures but they don’t control the ECB. Germany runs the show.

It’s not just Italy that’s having trouble, the whole EU is doing quite awful. Negative rates and poor regulations have strangled their banking sector. European banks are getting squeezed at the short end with negative rates and have to make up for it on the long end with higher interest rates. So actually lending in the EU is declining even though rates are falling. In essence, NIRP may depreciate your currency but at the cost of your banking system.

Japan is also learning this lesson. Not to be out done, the BoJ nuked themselves and have been paying the price. However, the Yen is a “safe haven” asset and when the BoJ nuked the Japanese banks they signaled a crisis which forced a lot of capital back into the Yen which strengthened as a result. So NIRP in Japan strengthened the Yen and hurt the already vulnerable banking system.

At the moment, neither the BoJ or the ECB is willing to increase their current QE programs and are only threatening further NIRP! It’s pure insanity but their banking sectors are going to implode as a result of this misguided policy.

So to say, China, who is actively working to prop up it’s banking system, will crash before Japan or the EU, who seem to be actively working to destroy their banking systems, is a hard call to make.

I think it is more important to focus on the forces at work and what they mean for other asset classes. In a sense, I’m attempting to be agnostic when it comes to time, and just benefit by the overall trend rather than a specific move. The overall trend here is lower interest rates, more debt, more deflation, more instability, more volatility, and less growth. The last one to me is key. The whole world is obsessed with GDP growth, so whether you think it’s a good statistic or not you have to follow it, and right now, growth especially coming out of Asia is falling dramatically. China, Singapore, Korea, Japan all reporting negative trade growth over the past quarter.

So I’m not saying that China won’t devalue it’s currency, a month ago I actually wrote an article comparing 2016 Yuan to US housing in 2008, but it’s important to realize that it is not the only possibility and there are perhaps less risky ways to make a smaller but strong return off asset classes that benefit from the same trends affecting China and the rest of the world.

Once again, I’ll bring up that the Chinese economy is incredibly fragile but there are still active participants doing everything they can to prop up the status quo, which makes it harder to predict as opposed to the Fed, ECB, and BoJ who are almost standing idly by as their respective economies burn to the ground. Remember, as long as the central bankers are involved, the global economy remains a confidence game, and the current capital flight certainly doesn’t bode well for the Chinese people’s confidence in the PBOC and CCP’s ability to manage it.