This is a long article, that you’ll find to be more free flowing than previous articles (Aka I was too lazy to trim some of the fat). I don’t apologize for the length. I find writing down my thoughts to be an incredibly helpful exercise. Just like I find publishing said writings to be incredibly cathartic. With that said, this post was originally supposed to be about China, but then it eventually morphed into a more generalized view on the global economy and the major sign posts I’m looking for as the year progresses. Enjoy!

Those who follow me have probably noticed by now the hefty emphasis I put on narrative when analyzing markets. Lately, the market narrative on China has gone “surprisingly” quiet.

This silence has persisted despite a tremendous amount of action going on underneath the surface.

Like a duck on a pond, China’s legs have been churning a mile a minute. In a country where every financial asset including P2P loans comes with an implicit “government guarantee” there is not much room for restraint. Combine this false sense of security with the PBOC’s almost uncontrolled stimulus in the post crisis era, and it’s not hard to see why the central authorities in China have been so busy over the past year.

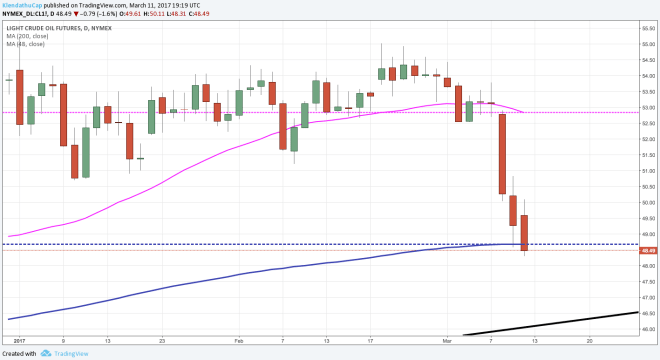

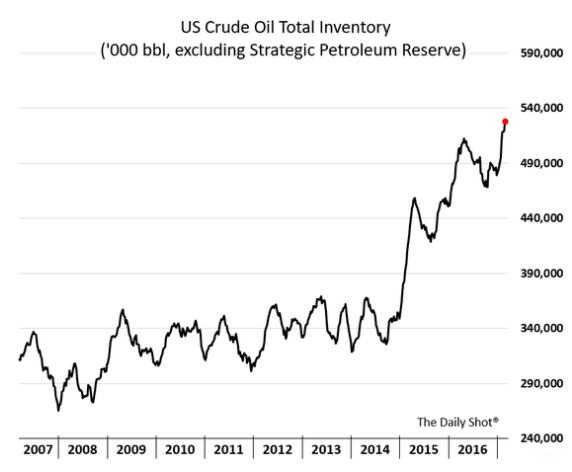

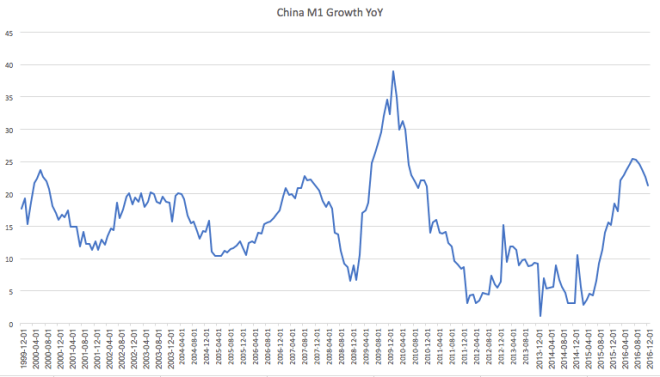

Recall that back in Q1 2016, the PBOC and Chinese government launched a massive stimulus program that forced a temporary bottom in not just China’s economy but the global economy as well. With the economy on a seemingly strong rebound, the PBOC began the process of tightening liquidity and imposing some restrictions on lenders.

Unfortunately, when a banking system is as interconnected and shadowy in nature as the Chinese banking system, this process of imposing any sort of discipline is incredibly difficult. From Caixin:

“No one in the banks knows where the money they invested in other banks’ wealth management plans ended up,” an official from the central bank told Caixin earlier. “They could not tell because the selling bank itself used the funds to buy other banks’ wealth management plans.”

So far the PBOC’s tighter monetary policy has gone on without a hitch (unless you count the December panic when a medium size brokerage firm attempted to default on its Trust Beneficiary Rights). As alluded to in the opening paragraph, this relative calm is only surface deep.

Underneath the calm waters, the risks in China’s banking system have merely shifted from one section to another, forcing the PBOC to play a game of whack-a-mole while providing just enough liquidity so that the whole system doesn’t collapse. By now, the ballooning size of Wealth Management Products and their increasing interconnectivity is well known as well known as what they are actually invested in is unknown.

“Along with the surge in the issuance of CDs, more than 15% of bank wealth management products were held by other banks as of June 2016, up from less than 4% at the beginning of 2015, an increase of 3.5 trillion yuan over a period of just 18 months, according to the report.”

What has been less talked about is the burgeoning role that interbank certificate deposits are playing in the Chinese banking system.

From the Caixin:

“In the first two weeks of March, the issuance of interbank negotiable certificates of deposit (CDs) exceeded 1 trillion yuan ($145 billion), following a record net increase of almost the same amount in February, according to data from Wind Information, a financial data provider. The issuance of CDs in January and February was 990 billion yuan and 1.97 trillion yuan respectively.

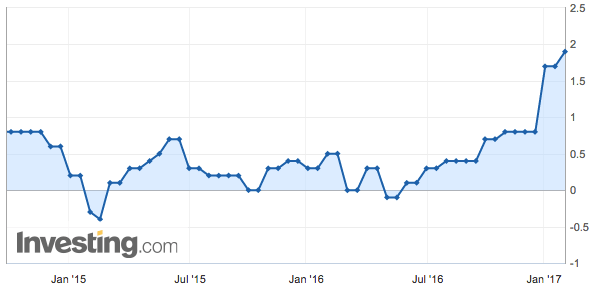

One possible reason for the explosion in CD issuance in recent months could be the dramatic increase in rates. Rising from 2.8% last August to 4.77% in March. Banks may be trying to lock in the cost of funding before it rises any further.

The interest rates that banks needed to offer to get funds through the CDs have increased as well, reaching an average of nearly 4.77% on March 22 for a three-month contract. In late August, when the central bank started raising money costs through open market operations by tightening the supply of short-term, cheaper funds, the rate was only about 2.8%.”

At the same time, about 48% of CDs are set to expire by the end of the Q2, further driving demand. Of course, these products will all be rolled over at much higher costs, hurting bank profitability. From Natixis Research:

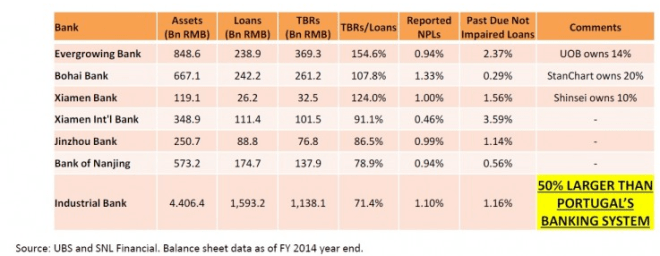

To make matters worse, the rising risk associated with interbank CDs is concentrated in the smaller less well capitalized banks. From Caixin (my emphasis in bold):

“Small and midsize banks have been the primary issuers of interbank CDs. According to a research report from Haitong Securities, nearly 90% of the 7.4 trillion yuan worth of outstanding CDs as of March were issued by the national joint-stock banks and city commercial banks.“

Just how poorly capitalized are these banks? From Caixin (my emphasis in bold):

“A simplified way to measure the leverage, as provided by the report, shows that, on average, the total assets of depository financial institutions in China (excluding the central bank) have grown to almost 50 times their net capital. The ratio for some midsize banks, which rely more on interbank loans, has reached 60. In 2007, the average ratio was just about 30.”

So what does this all mean? It seems that the PBOC’s runway to tighten liquidity in the interbank market will be significantly limited going forward. The fact that the PBOC has been able to tighten as much it has without incident is more illustrative of the incredible amount of excess liquidity in the system than its resiliency. Arguably no sector in China has benefited from these high levels of excess liquidity than real estate.

https://twitter.com/macrodidact/status/850423264430235648

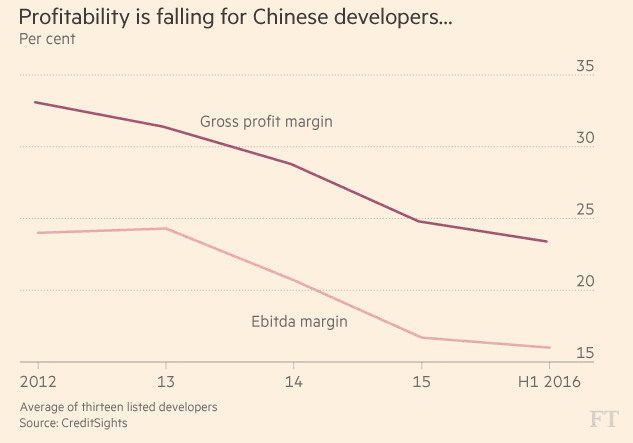

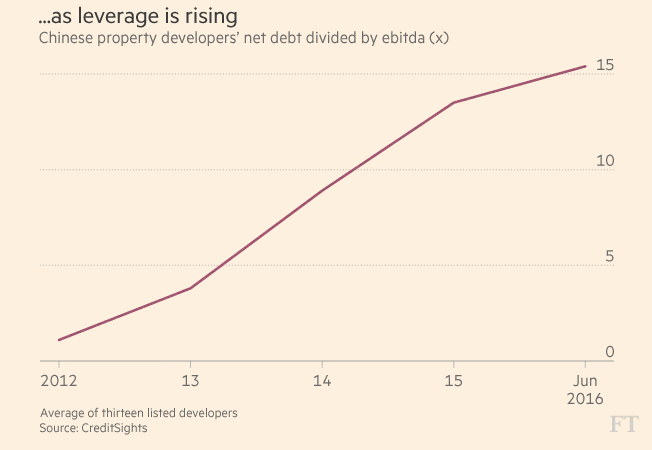

Despite house prices rising at their fastest rate in 7 years, profitability among developers has declined.

Falling profits and rising leverage against a falling liquidity backdrop is not exactly the ideal mix for a speculative bubble. But if you ask members of the PBOC, they don’t seem very worried at the moment. Apparently they’ve solved that seemingly “impossible trinity” problem.

From the SCMP:

“Chinese central bankers have done the economic “impossible”, finding a way to have a stable yuan, a free market and effective monetary policy.

That is the assessment of two central bank researchers, who claimed in a paper published on the People’s Bank of China’s website on Thursday that Beijing would continue to realize the “impossible trinity”.”

How does that saying go? Something something pride before the fall? This is almost as bad as the Latvian central banker claiming to be a “magic person”. To be clear Latvia hasn’t found itself in a heap of trouble, and the PBOC’s alleged conquering of the impossible trinity is not exactly an indicator of anything other than central banking hubris which let’s face it is always turned up to 11.

Central bank hubris aside, it’s true capital flight out of China has stopped… for now.

https://twitter.com/MNIEyeOnFX/status/850338062785761280

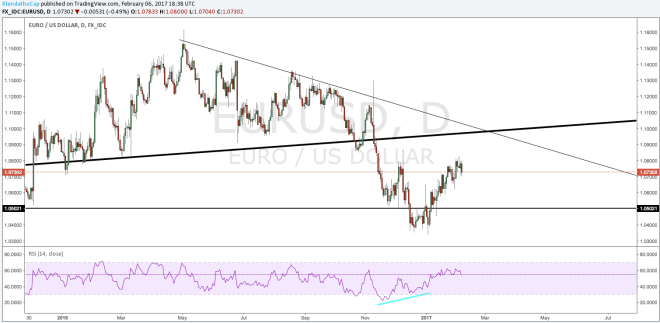

Which is not entirely surprising, from my post The Reflation Trade:

“I also see incredible potential for the PBOC to defend the psychologically important $3T reserve level this month. Come the release in early February, the market may be shocked to discover that the $3T reserve level has held. The Yuan could strengthen and the narrative would temporarily shift to the masterful job done by the Chinese Authorities, and developed markets would rally on the back of higher inflation.“

My oh my how the narrative shifts. Of course, China has not solved any of its problems. If anything they have grown larger, which has forced the authorities to take drastic actions. Like preventing foreign companies from taking their profits out of the country.

These stricter measures on top of a false sense of currency stability has emboldened Chinese corporates to ramp up their offshore dollar borrowing again. From the WSJ:

“Chinese firms have issued some $52.6 billion worth of U.S. dollar bonds in the first quarter, up 72% from the previous three months, according to Dealogic, and nearly five times the amount from the first quarter of 2016.”

One of the corporations borrowing dollars in the offshore market is one of the most indebted domestic property developers, Evergrande Group.

The purpose of this money is to “refinance existing debt”, because what else can Evergrande do? If Evergrande can’t get profits offshore (if it even has any) how on earth is it going to pay back this debt, unless it borrows even more dollars. From the WSJ (my emphasis in bold):

“In mid-March, one of China’s largest and most indebted property developers, China Evergrande Group , priced three dollar bonds in Hong Kong within a week for a total of $2.5 billion, which the company says it will use to refinance existing debt.”

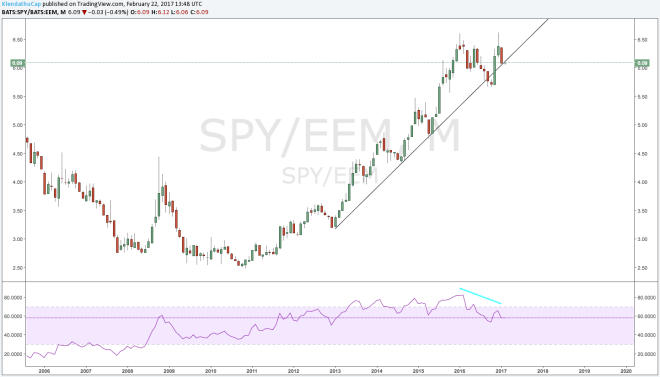

All it takes is for a little stability in China and everyone loses their minds. But Chinese corporates aren’t the only ones throwing caution to the wind. As pointed out numerous times on Twitter by Darth Macro, investors are increasing their exposure to Emerging Markets, despite deteriorating macroeconomic fundamentals.

https://twitter.com/RagnarD80/status/849914726544965633

https://twitter.com/RagnarD80/status/848328994676199424

https://twitter.com/macrodidact/status/850472001823055872

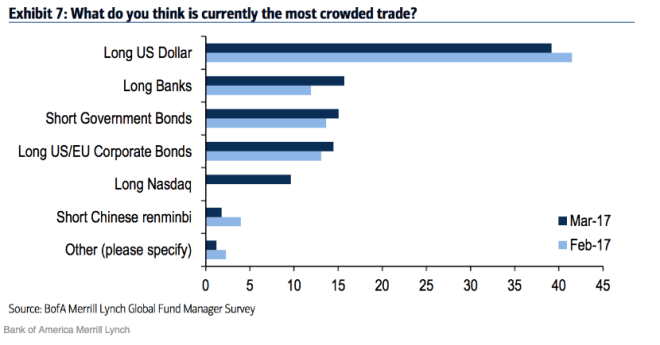

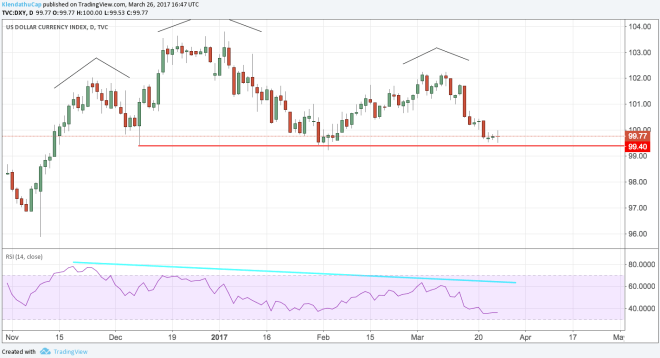

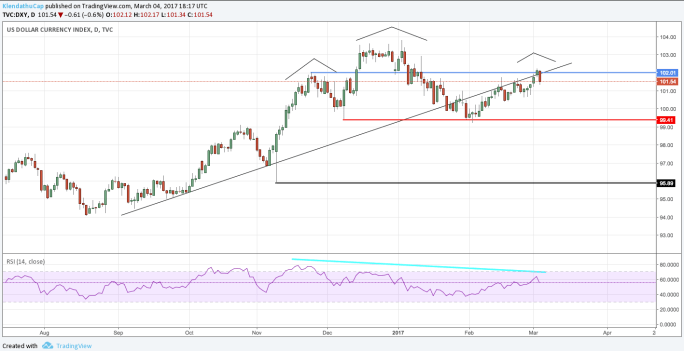

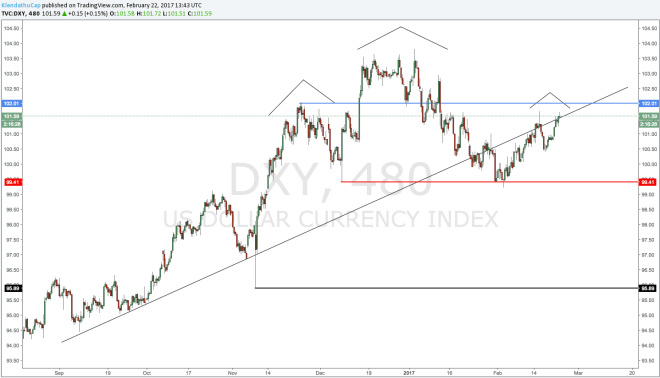

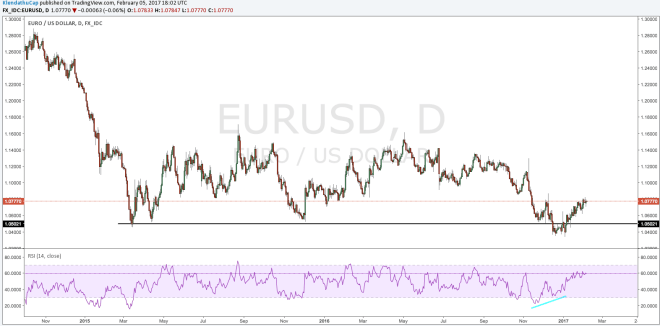

I think you get the point. Investors have looked around, and found the coast to be clear. Which is why I put an emphasis on the subsurface activity in China. Important to note that it is not just in China where the subsurface activity betrays the market narrative. Any China and EM related story would be unfinished if I did not touch on the US dollar, where once again we find the narrative to be in opposition to the underlying fundamentals. The following is a headline from the WSJ:

“Dollars shortages are now going away, helped by expectations that U.S. regulation will be relaxed, the success of overseas banks in finding alternative sources of finance and greater appetite from investors to pick up what looks like free money left lying around by the global financial system.”

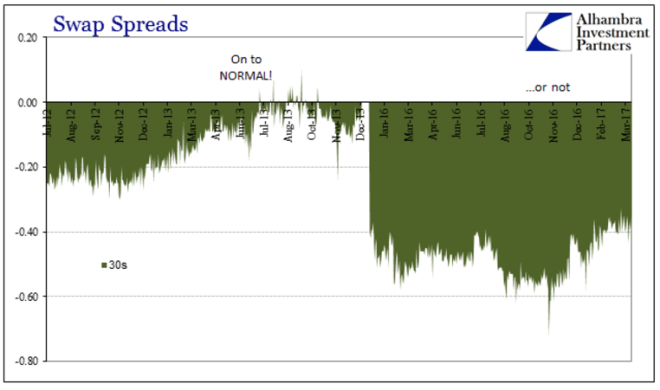

I’ll leave it to Jeffrey Snider of ALhambra Investment Partners to dispel any dollar flow myths. From his appropriately titled article:

“In 2013, the same sentiments were expressed only with QE3 in mind rather than regulations. It was only after the events of later 2014 forward completely and utterly surprised these mainstream opinions that it was after-the-fact decided regulations just had to be to blame. Even if we assume that was and is the case, the relative comparison of swap spreads (or UST yields, eurodollar futures, etc.) then versus now shows a very different interpretation than a return of dollar flow. Markets were much more excited and indicative of a that four years ago versus now, and given that turned out to be a false assertion, what does that say about the same one being prepared all over again?

For one, it was the 30-year swap spread that turned positive if only briefly in the summer of 2013. Almost four years later, the 30s have like the 10s improved but only in comparison to last year; they are still highly negative.”

In spite of this shortage of dollars, the Fed in all of its “wisdom”, has decided that now is the time to take away the punchbowl. After two back to back rate hikes the Fed has quickly moved on to balance sheet reduction.

The hawkish shift from the Fed in light of the subsurface problems in China is either hilarious or astounding depending on your disposition (I myself am half astounded half cracked up). Curiously enough, the most recent FOMC minutes tell a different story (my emphasis in bold).

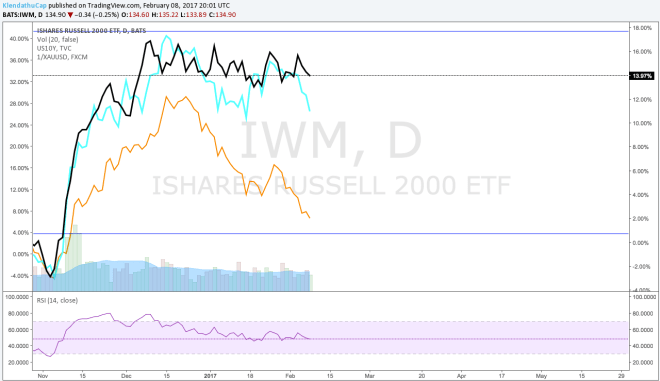

“Some participants viewed equity prices as quite high relative to standard valuation measures… prices of other risk assets, such as emerging market stocks, high-yield corporate bonds, and commercial real estate, had also risen significantly in recent months.”

Clearly they are worried about something, or as the quote suggests… pretty much everything. If high yield corporate bonds, commercial real estate and equity prices are all overvalued then there isn’t much room for anything else.

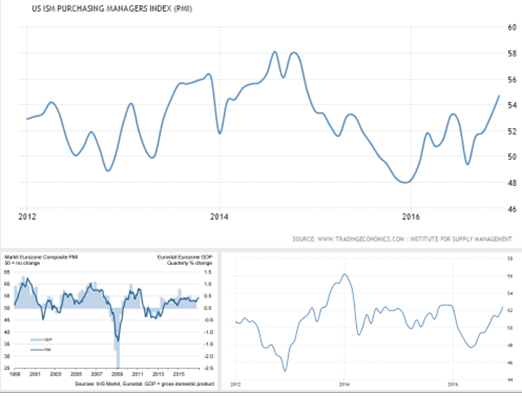

Perhaps even more importantly, the underlying US economy is not nearly as strong as the Fed’s hawkish rhetoric or the Trumpflation narrative would suggest. US Q1 GDP growth is weak per usual.

The latest jobs number was a dud as well. Amazon’s onslaught on the retail sector is accelerating.

Or maybe it’s more than Amazon’s creative destruction…

And this could just be the beginning of the bursting of a large multi-decade bubble in American retail stores. Retail square feet per capita in the US is 6x more than that of Europe or Japan. For all the grief Americans give China over its real estate boom, we have one of our own.

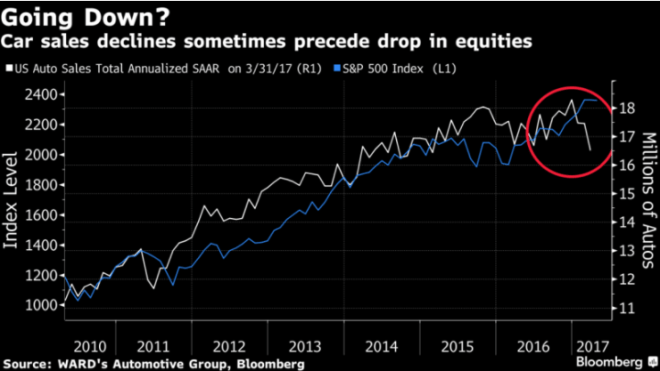

The bursting of this bubble will hurt and spread through out the economy, where we are seeing other bubblicious sectors suffer under tremendous strain. Auto sales have broken down.

Used car prices have dropped sharply.

Of course this not all that surprising given the state of the subprime auto loan bubble.

https://twitter.com/macrodidact/status/850462965476327424

Lastly, lending growth is slowing at an alarming rate.

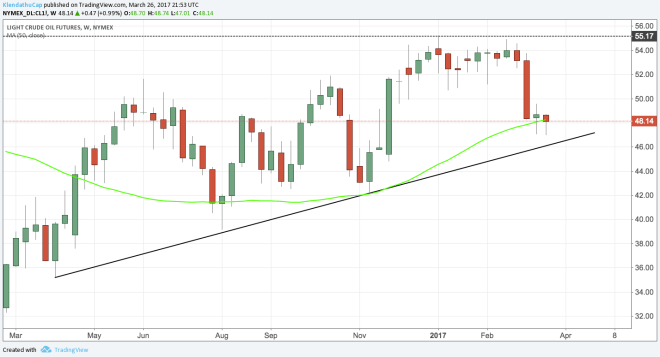

I know I’ve gone all over the map right now, so here I’ll try and wrangle some of these ideas back in. China’s economy although swimming in excess liquidity is going to face some headwinds towards the end of the year. Dollar liquidity although better than last year, is nowhere near a level to justify a hawkish Fed. US economic data, is nowhere near the level to justify a hawkish Fed. So why is the Fed hiking? An even better question might be: how have financial conditions been easing in the face of the hawkish Fed?

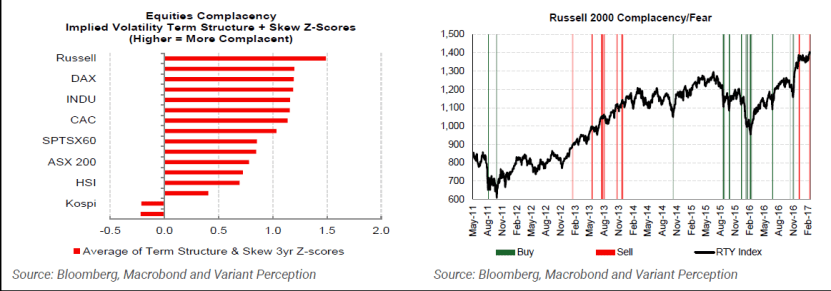

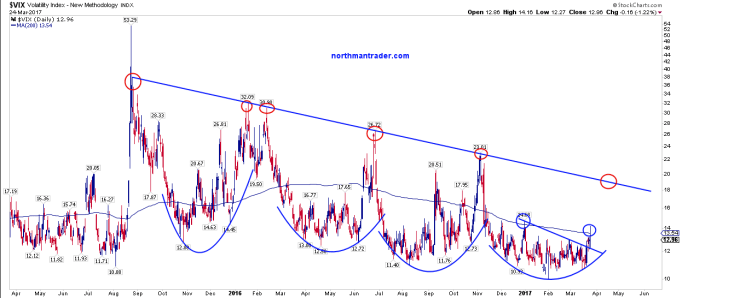

My answer for this strange development is the short vol crowd.

In this world of passive investing and ZIRP and NIRP, traders and now larger and larger asset managers are just looking for any excuse to sell vol. Every single time the VIX spikes above 13, it is immediately sold. This prevents equities from correcting and leads to a build up of risks in the system.

This is rampant selling of vol will lead to a whirlwind of unintended consequences, because it creates a false sense of security at the Federal Reserve. Historically the only thing that has stopped the Fed from hiking is a falling stock market. The Fed never responds to economic data, or dollar liquidity issues or anything of that sort. It only responds to falling stock prices. And if stock prices are being artificially propped up due to this “rampant selling of vol” then the Fed will keep on hiking or said differently vol sellers have numbed the Fed to its own hawkish policy!

It is quite likely given the rampant vol selling that the Fed has already tightened too much. Especially if you use the Wu-Xia shadow fed funds rate.

With that in mind, I think the odds of the stock market going considerably higher are quite limited. I’ve expressed my bearish views on the stock market for the past few months in a number of posts and believe my position has continued to be supported by the economic data as well as the capital flows. Dumb money in.

Smart money out.

https://twitter.com/jtepper2/status/850673339685318656

Add the two together and you get record dumb money longs and record smart money (commercial hedgers) short!

Now I don’t have a crystal ball, so I don’t know if stocks go up or down over the rest of the year. I’m just saying the odds that stocks continue to rise is falling at a rapid rate. But if stocks continue to rise, we should expect the Fed’s hawkish rhetoric to continue DESPITE any deterioration of economic data. When the next correction does come, I suspect any talk of “balance sheet reduction” will be dropped faster than Romulan Red Matter (although technically it was created by the Vulcans?).

DISCLAIMER: This blog is the diary of a twenty something millennial who has never stepped foot inside a wall street bank. He has not taken an economic or business course since high school (for which he is immensely proud of) and has been long gold since 2012 (which he is not so proud of). In short his opinions and experiences make him uniquely unqualified to give advice. This blog post is NOT advice to buy or sell securities. He may have positions in the aforementioned trades/securities. He may change his opinion the instant the post is published. In short, what follows is pure fiction based loosely in the reality of the ever shifting narrative of the markets. These posts are meant for enjoyment and self reflection and nothing else. So ENJOY and REFLECT!